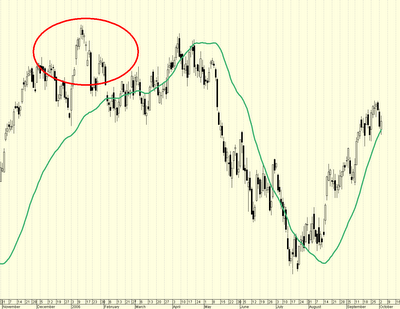

So, isn't this market just a peach? I had a few minutes and thought I'd post a little doo-dad which is one of the dozen datapoints I use to validate short term bottoms. Works on stocks, bonds, pickup trucks, whatever. It might seem simple but it is not. I learned long ago not to use what other traders use or what other professionals use. There are too many hedge funds using the exact same black box models and their work will eventually erode and likely fail as everyone crowds into the same trades. I don't really care to see my work erode over time so I don't use anything which is easily replicated or used by anyone else. This isn't part of any long term work I do but just this single data point kept me out of the half a dozen bottoms called by Wall Street professionals from May to August. Think I could find a monkey to push a buttom for buys and sells and start a hedge fund? Green line up? Buy. Green line down? Sell.

Frankly, this is an extremely weak bottom. That is, if you call this a bottom. I prefer to think of it is just more yo-yoing around although using this data point alone would make for some great returns in this type of psycho market.

I circled the move in January for a reason. Do you want to know what that move was? That was a primer. Does anyone remember the hoopla reported by the press that week as we hit new highs? That move was used to prime the average investor into chasing everything from penny stocks to pink sheet stocks to blow offs in oils, metals, transports, brokers, emerging markets, etc. Likely the wave 5 of this bull market's leaders. During that rally into May, the big money was dumping

ALOT of shares. I gave a few hints of this in some posts I made on other blogs as it was happening. The last time that happened? The outcome was very ugly.

<< Home