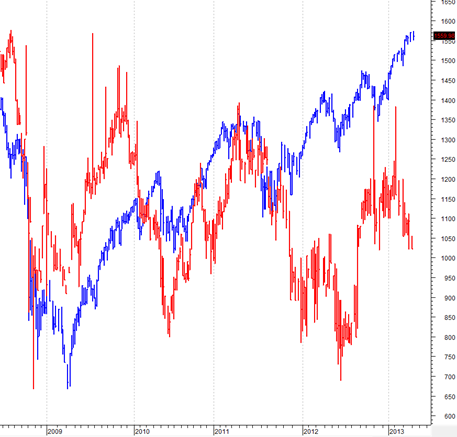

European Sovereign Debt And The S&P 500

I have shown this graphic before. It is a composite of European sovereign debt in red overlaid on the S&P. The correlation is nearly perfect except since the start of 2013 when the S&P disconnected and pushed to new highs on the threat of new debt concerns in Europe. Without looking, I believe it was the first trading day of the new year and they actually gapped the S&P futures market upward. Something that never happens. So, I’m not sure who did this, but it was contrived. We never filled that gap. Trader talk that many people may not understand but I’m short on time so no explanations.

Let me end by saying many U.S. corporations and U.S. banks are headed for disaster if we have a full European sovereign debt crisis or a repudiation of European sovereign debt. That is a reason for this correlation. Maybe I shouldn’t use the term sovereign since Europe is enslaved to German fascism. Financial algorithms (that will ultimately fail) drive all of these financial market movements. Why the disconnect in 2013? A rush of dumb money? Central bank buying? Who knows.

<< Home