Federal Reserve To Buy $600 Billion In Treasuries

We wrote on here that the Treasury purchase program changed the game and we expected it to be expanded in the future. And that doing so would change the supply and demand characteristics of the Treasury market and absolutely murder the Treasury bears. Well, the future is now.

Those short Treasuries are getting murdered because they relied on opinions rather than a defined trading strategy or algorithms, a fool’s game in this type of environment. There are simply too many blind spots and too few people who really understand monetary policy to rely on opinions.

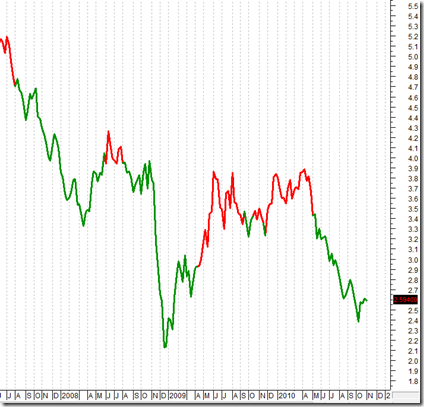

Below is the ten year Treasury bond since this crisis started in mid 2008 with a trading algorithm applied to it. Buy bonds when the algorithm is green. Sell bonds when the algorithm is red. Just a handful of trades in three years. It’s pretty simple and there is no opinion necessary.

The ‘pretenders’ are being weeded out. There are very few people out there who actually rely on anything other than opinions, bias and emotions for their analysis.

<< Home