Massive Positive Volume Spikes In Equity Markets

Not surprisingly, Wall Street is as bullish as it was in 2008 before the collapse and Barron’s has again succumbed to the idiocy of Wall Street with its cover story of a week ago. The market has continued to grind higher.on very anemic volume ratios and incredibly weak overall volume as we have remarked. We have printed day after day of the lowest volume readings of the year in the last two months. This is to be expected as we have been writing since the 2009 market low that Wall Street would eventually crowd out other economic interests in financial markets through market rigging and manipulation. And that it is derivatives rather than fundamentals that are driving this rally.

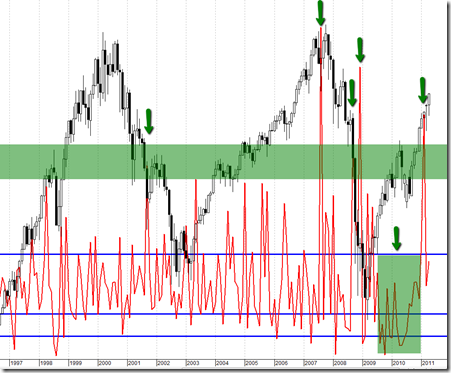

Let’s look at a monthly graphic below. The red graph is of monthly positive volume spikes. The higher the spike, the greater the enthusiasm in markets. Every single massive positive volume spike (highlighted as in or above the green horizontal band shown cross the entire chart) has been followed by months of treading water or by eventual declines or both. Well, except this last one that just occurred…… Or at least not yet.

Interestingly, if one goes back over the last thirty years or more years, these relatively recent instances of massive positive volume spikes are nonexistent. Four of the largest volume spikes in the history of the data set I have occurred at or since the 2008 peak. Two happened in the middle of the 2008 collapse when it was quite common to hear Wall Streeters, both bull and bear, calling for people to buy stocks on the way down. And the market rammed those calls right down their throats while we remained bearish until early 2009.

These massive spikes are recent phenomenon for a reason. Wall Street has perfected the concept of fraudulent speculation. As we have remarked, our banking system is able to literally print money out of thin air to buy financial assets. This dynamic is a recent invention of our corrupt banking system enabled by a corrupt political system. The supply of money to speculate is only limited by the scale of the frenzy Wall Street is able to build for any particular fraud. And that means no concept of intrinsic value remains in any financial asset that is the target of speculation. Every financial asset is a bet whose price is driven by enormous leverage. Value does not exist and anyone who says it does, is deluded and truly understands nothing of what the greatest value investor of all time, Ben Graham, espoused or what investing truly is about.

This means until the largest financial bubble in the history of the world (literally) pops, there is absolutely no way to determine any go-forward and sustainable price level in any asset that is the target of speculation. That includes BRIC country assets, emerging markets, corrupt equity markets, global production capacity, gold, silver, bond markets, advertising, quantitative finance, real estate markets, hedge funds, private equity, farm land, food prices, oil, commodity markets, lobbyists, mergers & acquisitions, fraud & corruption, immoral government, the two party political system, financial advisors, healthcare, industrial food production, the war state, the corporate state, economic oligopolies & monopolies and MBAs (The unthinking and immoral[amoral] Soviet-style bureaucrat needed to perpetuate all of these frauds.). And we have written of the eventual doom of all of these countless times over the last six years. These are all massive bubbles created not by fundamental demand or sustainability but enabled by greater and greater leverage of a fraudulent banking system; the antichrist of the 21st century on a level of evil as great as any we have seen in the last one hundred years.

In closing, notice the small green box in the lower right corner of the graph. The volume spikes off of the 2009 rally low are the most anemic on the fifteen year chart. This rally has far and away the lowest positive volume in the last fifteen years. There isn’t anything even comparable. And if the graphic is expanded, there is nothing comparable throughout history either. The rally off of the 2009 lows is driven completely by leverage and derivatives. By Frankenstein finance. And that is what we would expect. Fundamental demand for financial assets has imploded as wealth concentrates further and further into the hands of fewer and fewer. A relative handful of players are propping up all financial assets. And one player is then propping up these relative handful of players; the immoral Federal Reserve. As we have said countless times, Wall Street and the investor class are the dumb money. And they are holding the bag on speculative assets once again. It’s simply a matter of when exogenous events bring down the house of cards one more time.

If the last fifteen years shown below is any indication, the recent spike (A few months ago) in positive volume, the first monthly spike in a rising market since the 2008 market peak, will soon be leading to a weaker market, consolidation or worse. (Older data really is not relevant because Wall Street had yet to perfect the printing of money to speculate in financial markets before then.) With this spike, is the investor class once again “all in”? This at a time when Wall Street is once again wildly bullish. Bullish not as determined by sentiment surveys or what they are saying but by what they are doing.

<< Home