Bear Fatigue Part Deux - Is It That Time?

Not long after this liquidity inspired rally in financial markets started in early 2009, we gave two anticipated turn dates for that rally to end. That was May of 2010 and third quarter of 2010. We have referenced this quite a few times since and from much of my work, this date is still the most important date since the 2008 collapse. Market internals I measure by backing out Frankenstein finance’s impact have not recovered. We have highlighted this multiple times over the last handful of months.

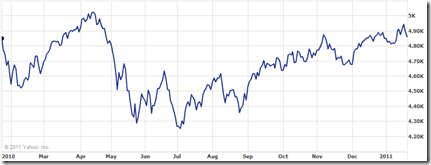

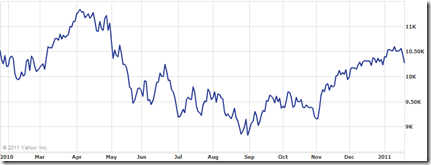

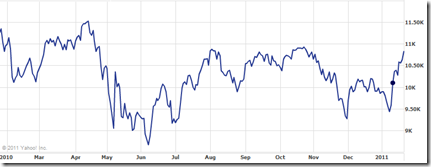

I think it’s telling that many of these stock exchanges, so key to globalization, have failed to take the April 2010 highs. And now in early 2011 we see Wall Street the most bullish it has been since its collapse, Wall Street more leveraged into commodities than at any time in history and Wall Street getting out of Treasuries and plowing into risky assets at the fastest pace since 2004. All of this while many indices haven’t been able to push through new highs for nine months now.

As we have noted a few times, if one understands economics and how capital flows through an economy, you would know China has been collapsing since it’s stock market bubble imploded in 2008. A collapse we wrote would happen when the entire would was completely deluded by the fantasy of the Asian century. That we have not seen a single person report this and instead had countless financial masters of the universe re-pump the China story since, shows the effect of bailing out systemic incompetence. Insanity, by definition, is doing the same thing over and over and expecting a different result. Our financial system is run by people who are insane. Or at least, insanely clueless. Too many people think with their eyes aka the ego instead of understanding how the world actually works. ie, China’s real estate and automotive sectors kicked into overdrive after the collapse because demand for capital disappeared. That is clear and incontrovertible evidence of impending doom – Something we wrote about on here back in 2009. I’m sure countless people read my diatribes with substantial doubt. Truth is free for all who seek it. They don’t teach that at Harvard or on Wall Street and those who seek control are never going to find it.

I have little doubt we will look back on these moments of history with horror as the status quo’s Humpty Dumpty global economy is finally exposed as systemically and permanently broken. This is something one could have predicted would happen a long, long time ago. It was just a matter of when.

There is still plenty of time to see both the Democratic and Republican party fall from grace, potentially forever, before the 2012 elections – their just reward for failing to address the corrupt anti-democratic environment they have created. Remember, soon after Obama’s election, we wrote that a third political party Presidential candidate could emerge in 2012. Maybe that will simply be a candidate to challenge Obama in the Democratic primaries. We obviously don’t know. But as events unfold, I believe the evidence is more compelling than ever that President Obama will be sacked in 2012.

It has been some months, maybe even more than a year since we have remarked of it, but our long-discussed downside target for the S&P of 200-450 has NOT changed. Nor has our oft remarked downside possibility for $10 per barrel oil.

<< Home