Commodities: Copper Update

Over the years we have written a lot about copper on here. Pairs trading, economic utility, Chile’s equity market and economy, stock market indicator, economic indicator, etc. This is all a rehash of prior posts but it is worth repeating for both long time readers and new readers.

By the way, this brings to mind a timely remark since we have been writing about the coming bust in commodities since long before the 2008 collapse. We are essentially waiting on dozens of expected outcomes we have written about. Dozens of anticipated outcomes have already come to pass and many more will surely follow. The only outcome we have changed our perspective on is our expectation for U.S. government bonds. Originally, we wrote that as the world economy came crashing down that foreign countries will no longer be in a position to buy U.S. debt, something that is still in play, but we wrote that will likely increase U.S. borrowing costs. But as we have written, this is a position that is no longer in play until the Federal Reserve no longer purchases government bonds. This dynamic has changed demand characteristics. At least until they no longer are buying them. I think we are going to see substantially more of the Federal Reserve involved in the U.S. government debt market in one way or another. A post next week will highlight this point again.

Okay, back to copper. The direction of copper is a remarkably accurate indicator of economic activity or liquidity as one would expect. That said, copper never in the last one hundred years exceeded the range of 50-70 cents a pound. It didn’t matter if the dollar was backed by gold or was backed by fiat decree or if they dollar was worth 90% more than it was today or whether Europe was in the throws of its massive rebuilding after World War II or whatever. The value of copper was consistent in its economic price elasticity characteristics relative to money. That is, until today. Remember, it’s never different this time when the prevailing wisdom is that it is different. Especially when that prevailing wisdom is comprised of bureaucrats on Wall Street.

What has made it different this time is financial manipulation. Frankenfinance came into its full glory within the last ten years and with it the manipulation of commodities. Wall Street has inserted itself into the supply chain for copper to extort economic users of the product just as it has for other commodities. So, the U.S. floods China with money for economic development and then extorts its fair share of all commodities that China will buy and that leads to massive profits on Wall Street as the financial crime families take their cut. It’s just like in the mafia movies. Except the mafia is our financial system defrauding its unique position as having the world’s reserve currency. The fraud in our country is massive and extends to preying on people in nearly every country on earth. In particular, foodstuffs and energy manipulation are causing massive crisis and hunger with the world’s poor courtesy of Wall Street. And you thought they were just preying on Americans. Haha. The fascist state seeks to extort everyone for its power and greed.

Even today with high energy prices, copper costs approximately 5c a pound to mine. That’s right dog breath. 5c. So why the discrepancy between cost and price? In other words, why is copper trading at at 10,000% markup to its mining costs? Are we at peak copper as noted by a noted financial clown three years ago? The same conclusion drawn by equally brainwashed minds telling us the high price of oil is because we are at Peak Oil or peak carbon energy? Come on. That’s a false choice made by false thinking.

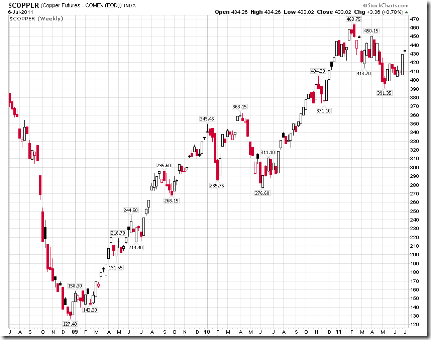

As we have noted countless times, patterns are of value because human nature, the rhythm of economics and natural forces at work in our world are cyclical or repeatable. This copper pattern has both a price and time component as an A-B-C pattern and as a Lindsay’s analysis of middle sections and time symmetry. The time component is exhausted. The price component, depending on one of two interpretations is either exhausted or could actually reach about $5.10-5.20 a pound. If it is to reach beyond current price highs, I would expect that to happen very rapidly given the time element involved.

It’s obvious I am ratcheting up the rhetoric over the last month or so on commodities as I did near the peak of the commodities bubble back in 2008. Because the system is becoming wobbly again and another collapse could very well be aligning before the end of the year. Especially if the crooks get their way in the short term by instituting global austerity measures. That will eventually lead to more liquidity shocks and plunge us into another economic mess. A much worse economic mess as we have cited numerous times.

<< Home