S&P 500 And Treasury Market/Debt Default Update

Let me first reiterate something I have said time and again on here. If there are no other alternatives presented or allowed (monetization), we should default on our government debts associated with the tyranny of corporate capitalism and empire. This will pave the way for positive economic, monetary and banking system reform. Iceland defaulted on its foreign debts and the Ponzi schemes of its bankers and I didn’t see anyone die. The failure of this global system will certainly cause more pain than Iceland experienced but defaulting does not make the U.S. a deadbeat as Obama clearly speaks mistruths if not outright lies. Additionally, I or no one else I am aware of ever agreed to pay state debts created through corporate welfare, rigging of the game by the plutocracy, corporate capitalism’s socializing losses and privatizing gains and endless corporate state war. When he states that the U.S. always pays its obligations, who the hell is he talking about? I am the U.S. and you are the U.S. We never agreed to pay any such obligations. Do you remember ever signing a contract to repay the plutocracy’s debts?

This reminds me of 1776 and the British empire’s attempted to get the colonies to pay their massive debts of empire, endless war, private bankers and corporations; the British corporate empire’s plutocracy. It is literally no different. Debt slavery of the British corporate empire now defines American corporate empire.

What legal obligation do We The People actually have to repay the profligacy of the plutocracy other than through the repressive violence imposed through force by our corporate state masters. Our masters excel at one thing – spending The People’s money and then trying to force American citizens into believing they are accountable for paying for it. Obama may believe the U.S. isn’t a deadbeat but he certainly does not speak for me. I, for one, am more than willing to let that label be applied to me. The words I have to describe the vulgarity of politicians are more than I am willing to type. Oh, and I have no problem getting in the gutter and verbally mixing it up with the plutocracy either so it certainly isn’t beneath me.

Before I get to the S&P 500, let me spend a few paragraphs remarking about the possibility of default or some type of Treasury market event. Depending on how many posts you have read on here, you may or may not know that I have remarked for some years of 2013 being a possible date for just such an event. This projection date is unique to my work as is almost everything I wrote about as it pertains to the economy and markets. I don’t really pay much attention to what others think. Because most everyone else is simply regurgitating something else when it comes to both. It was just a handful of months ago I remarked of the unprecedented House effort to prioritize spending in preparation for a possible default; something no one in the mainstream really paid attention to.

There is an endless stream of pundits stating that a default is impossible. And, they give all of the rational reasons why. They certainly all sound quite rational to most people but they miss the mark on many levels. The most obvious is an arrogance and lack of respect that completely discounts factors they don’t understand or aren’t aware of. Everyone has become an expert in the age of the Internet. People just open their mouths and diarrhea flows forth like the Mississippi River. There are countless things we don’t know or aren’t privy to that make it impossible to state as a matter of fact that we will not default.

One simple example is that quantitative easing is used by the Treasury to essentially fund the government with zero percent interest bonds. Those bonds are short term and roll over every week. So, not only do we need money to fund the government, some of which would continue to roll in through taxes, but if investors are no longer willing to roll over those bonds at auction every week, or they are unwilling to do so at essentially zero percent interest, then the Treasury market could experience an unprecedented crisis. The possibility of this very event was discussed on here years ago. Then what happens to short term Treasury-backed money markets? And on and on. Frankly, we are closer to crisis in the Treasury market than at any time in our history. Regardless, as noted on here ad nauseam, this system is finished. It’s just a matter of how and when as the status quo does everything in its power to maintain control.

I’ve noted my disdain for conspiracy theorists on here time and again but it’s also impossible to deny the level of corruption and secrecy in this nation that leaves all of us wondering what is really behind door number one. The corruption is well beyond what most people are willing to admit to themselves. That’s why we still have a delusional and complicit mainstream press and so many Americans so willing to support the partisan mud slinging on behalf of their political team, in hopes that they win, rather than recognize reality. That is, you don’t have a team. You shill for your masters and your own tyranny and victimization. More of that dumbing-down of our society that those closest to the top and to the faux political memes are often the most ignorant. Isn’t it a great irony how they petulantly mock others because they believe they are so enlightened. This is very typical of big “L” liberals who are tied to the Democratic Party.

Maybe the corruption is nothing more than the invisible hand of self-interested corporate state profit. But maybe it’s more. No one really knows with transparency but what if all of this debt wrangling is all nothing more than political theater? Only a few people would actually need to know it is theater to make it such. All other participants could be unwittingly playing a role in creating it.

How do you know that the corporatocracy won’t use an actual default to scare Americans into accepting austerity as that is the only way they can maintain control? How do you know there is not a national security state/military-industrial complex agenda of super patriots (Bill Moyers’ term to describe the secret national security state) to use a selective default on foreign debt to destroy China, America’s only real competitor to global hegemony? (This is certainly not impossible to consider given the U.S. has been found to be spying on foreign corporations and governments not just for political reasons but, more importantly to extend empire aka economic and military reasons.) How do you know there are not forces at work beyond that of human comprehension that may have already created the outcome of this moment? (Free will aka control as we like to believe, is likely an ego-driven perception or delusion to some substantial degree. Some of that seems quite provable.) How do you know that this debt dilemma isn’t being used as a precursor to flood U.S. streets with the military and the imposition of martial law given the unprecedented rise and power of the military-industrial complex and America’s historical comparative to the collapse of Roman self-rule and the rise of Roman standing armies and the military-industrial complex aka empire? The list of possibilities that would explain this staggering level of secrecy is quite substantial. And whatever it is, does money and greed alone really explain the naked aggression and unprecedented secrecy of the corporate state that, in many ways, seems hell bent on violently destroying everything it can that gets in its way? This aggression appears more concerned with power than money. In other words, more concerned with empire and defeating any opposition to it.

For those pundits who believe a default is impossible and give us endless supposed rational analyses, how do you explain all of human history? History is nothing more than a repudiation of endless rational analyses. In the richest and most powerful society the world has ever seen is it rational that the 2008 crisis should have happened? Is it rational that 25% of Americans should be unemployed in the richest nation the world has ever seen? Is it rational that 100 million Americans should be living paycheck to paycheck in marginal jobs in the richest nation the world has ever seen? Is it rational that 50 million Americans should be on food stamps in the richest nation the world has ever seen? Is it rational that 500,000 Americans should have had to die to stop slavery, an incredible affront to humanity in a country founded on the principles of humanity? Is it rational that World War II should have happened after countless destruction and loss of life in the “war to end all wars”? Was it rational that the richest nation the world had ever seen at that time, the Roman Empire, should have collapsed from within? Is it rational that the Soviet Union, the second most powerful, and in many ways, the second wealthiest nation in human history should have collapsed from within? The list of “this never should have happened” or never was predicted by rational analysis is endless. Maybe we will see a Treasury market event or maybe we won’t. But did any of these people stating that default is an impossibility anticipate we would have gotten this far down the road of possible default just a few months ago?

Now let’s move on to equity markets. We have recently witnessed the strongest rally since the short covering pulse off of the 2008 crash since the fourth quarter 2012 correction. This rally, since the fourth quarter of 2012, comprised almost 400 S&P points. That is a massive rally adding trillions to the value of U.S. equities.

Up until that point technical internals in the U.S. were very weak as I have shown on here quite a few times. In fact, the market preceding the late 2012 correction was very choppy with limited upside demand. What changed? Well, quite a few things actually.

Hot money has rotated out of commodities and emerging markets and has been repatriated to U.S. and European markets in record amounts over the last year. That money has driven a spike in U.S. asset prices and a collapse in emerging markets. And, I would argue that rotation back into the U.S. has driven a spike in U.S. production. More neoliberalism. These are certainly not signs of sustainable economics but when assets are rising, it creates a perception of wealth by those who own assets. What do then they do? Buy, buy, buy. This is simply more of the same criminal rent-seeking capitalism. Wages and employment have not picked up. Nor will they.

We see this same dynamic occurring in Europe as I type this. U.S. and European hot money that has been repatriated from emerging markets is now buying European assets en masse. And, they are telling us that they bottom is in in Europe. Al of the pliant mainstream financial press is busy regurgitating financial predator talking points as fact. Again, this repatriation of hot money has had an effect of rising asset prices and of buying distressed assets, thus adding some temporary fuel to the European economy and, thus, we also see a spike in production in parts of Europe. Again, wages and employment have not picked up. Nor will they.

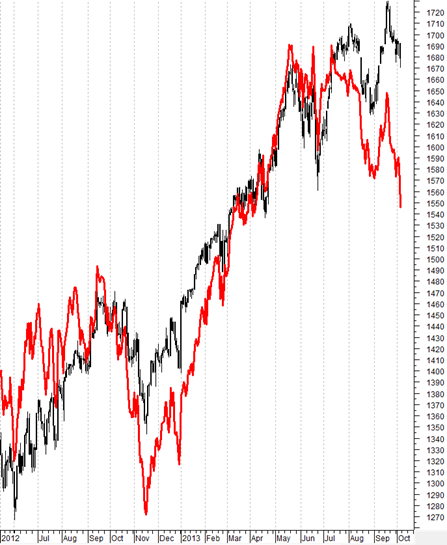

But now that the financial masters of the universe are more bullish on equities and the economy than they have been in a decade, as noted in prior posts, Houston, there is a problem. Above is my unmanipulated NYSE advance-decline algorithm in red overlaid on the S&P 500 cash index. (This chart was pulled last Friday so it is a few days old.) After a massive upward assault that is nearly without precedence, in the last five months the advance-decline data has been stuck while prices attempt to make new highs. While this is not yet a major trend, the demand for stocks is weakening with lower lows and lower highs in the advance-decline data while the S&P 500 cash index makes higher highs and higher lows.

Now that all of this hot money has been repatriated and put to work in stocks and other speculative financial games, where will new demand come from? There is no intrinsic demand created by increasing wealth. Because there is no increasing wealth being created. The Fed’s money printing is not having any positive effect either. To the contrary, its negative effects and impacts are now increasing.

Something has to give. We either see a pickup in demand for equities or we see prices fall accordingly. The short term trend is clearly that equity prices are adjusting downward to reflect lower demand over the last five months. While we could have a reflex rally at any time, or not, if I consider demand and price to be in equilibrium, prices should be at 1550 on the S&P right now. Although life doesn’t always work out so elegantly, it clearly gives us some indication that demand is fading quite substantially in this very moment. And it has nothing to do with Washington’s budget talks. Although every talking head will tell you it does. It has to do with the global economy starting to fall off of a cliff again as noted in many data points highlighted in posts this year. Just at the time that Democrat and Republican Washington politicians put on their asshats again.

If prices continue downward in coming months, I wonder how that will affect the record bullishness of Goldman Sachs on equities and the record bullishness of millionaire’s on the future of the economy? Both noted on here a handful of posts ago. And their desire to consume? Because it sure as hell isn’t the 100 million Americans in marginal jobs or on food stamps that are keeping this hyper-consumerism Humpty Dumpty afloat. Just sayin.

<< Home