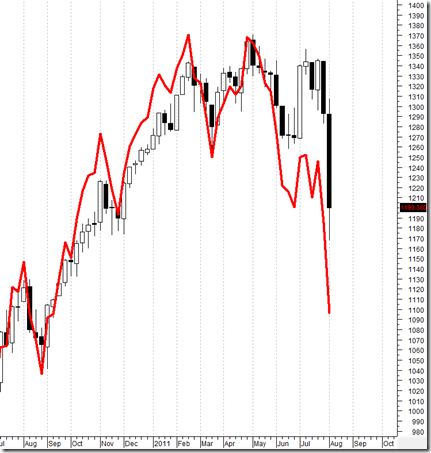

Updated Advance-Decline Data Post From A Few Weeks Ago Confirmed Coming Market Weakness

Below is the weekly unmanipulated advance-decline data I personally use. I showed it a few weeks ago while remarking that data for the past few months had not confirmed the market’s rise during that time. This is similar to the market peak of a few years ago where the data was not confirming a new high. That marked the beginning of the end and ultimately led into the financial collapse. In other words, when the market is exhausted and fundamentals are not replenishing it, we see the economy start to roll over and financial crisis start to rise as a result.

The market has dropped from about 1332 since we posted this graphic a few weeks ago. And as an updated look at this graph shows, the weekly advance-decline data is now making substantially new lows. Today it looks like the futures are pointing to an open close to 1150 (1150 is substantial support). That means essentially the market has now done just about nothing since the fall season of 2009.

I want to reiterate something I have written ad nauseam over the last six years. Equity markets at anywhere near these price levels are massively more overvalued than the market in 1929 before it ultimately fell 90%. And, that stock market price levels in today’s world have absolutely no relevance to reality. The direction simply tells us the extent of which the status quo is in trouble or in control.

Now, while I would not be surprised to see a bounce around 1150 or close to where we are opening up, I would also not be surprised to see more downward pressure.

<< Home