Revised GDP Is Negative And It’s Not The Weather

The recently cited survey of nary a single economist expecting GDP to contract any time in 2014 was released right on time. Revised GDP didn’t disappoint. It was negative as everyone has likely seen by now. Thus, once again proving that economics as taught in universities is only propped up by state actors. If we really had a free market and decisions were made through natural selection, economists would disappear. Like the Dodo and Dinosaur. And like the investor class, the political class and the capitalist class. Like Wall Street and the vast majority of corporations. But, instead since the economics profession is essentially funded very substantially by the propped up Federal Reserve and its centralized fascist structure, this profession also remains propped up. For now. We might yet see this “profession’s” extinction in our lifetimes. At least as it is taught today.

Let’s allow the spin doctors at the Whitehouse explain why first quarter GDP was negative. Oh, it was weather. Doh! What a surprise. Why expect any real appreciation that correlation is not causation from the anti-science crowd at 1600 Pennsylvania Avenue? They apply the same flawed correlated reasoning to GDP as they do global warming.

Psst. Here’s a not-so-secret-secret. In December I reported on here that we were witnessing the biggest profit warning in U.S. recorded history. Umm, this contraction all started before any weather-related effects. Just like hundreds of thousands of years of ice core samples clearly show that global warming is not driven by lagging C02 levels but is certainly correlated to it.

Now, the Whitehouse and economists will tell you that GDP will rebound substantially with pent up demand in 2Q. Of course, this isn’t based on any type of scientific analysis. It’s just more corporate state propaganda and spin. Don’t bet on it. This quarter’s economic data looks soft as well.

If you appreciate that a service or servant-based economy requires greater and greater debt-driven spending and consumption, well, and servant poverty wages to serve up those services to class privilege, then you can appreciate this dynamic is a form of emotional violence perpetuated by capitalism and the state. At some point, people realize that. Often through emotional exhaustion or when it’s a choice between bread and a bigger debt payment.

So… not only are the money printers running out of gas, or creating massive and painful distortions that are causing them to take their foot off the gas pedal, but guess what else? Upwards of $5 trillion in stock buy backs has helped to prop up equity shares over the last five years. Well, as has record margin debt, leveraged derivatives and the money printers. More of that deceit, lies and manipulation of corporate state financial engineering. Of course, all to the benefit of our corporate masters who lined their pockets through share repurchases. And then for good measure used some of that money to buy Washington and state capital politicians courtesy of the Supreme Court.

Why wasn’t that $5 trillion spent to create jobs in this nation? Or to invest in capital expenditures? (Remember, as noted on here many times over the last nine years, we are in a capital spending depression and have been for decades.) Or wealth creation for our nation? Or to raise wages out of poverty? Or to pay taxes? Hahaha. Does anyone actually believe our masters give a shit if we have a job, a living wage or a roof over our head? They booted millions of Americans out of their homes, trashed private pensions over the last 20 years and stole our wages to pay themselves a king’s ransom. Does anyone really think the capitalist class, the political class or our King Obama cares? He spends his days golfing and playing basketball. Well, and spending $40 million of other people’s money on vacations while an unprecedented number of Americans slip into poverty. Gotta love those jobs and economic programs he has created. Oh, that’s right. What jobs and economic programs? Well unless it is for China or other nations through the TPP.

Masters always choose higher profits before clothing, feeding and housing more of us lowly cotton-picking wage slaves. That only happens after the master has had his fill of gluttony of the backs off his slave’s labor. There will be no jobs recovery as written on here ad nauseam.

But with declining profit margins, earnings misses, and even losses starting to accrue in the corporate state, we can expect that we have either seen or will soon see the Ponzi Scheme of corporate share buybacks hit a massive, unprecedented peak.

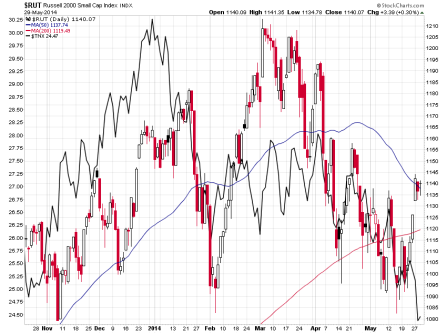

So, in closing let’s take a look at the Russell 2000, an index discussed on here quite a few times in the last few years given it has reached a valuation of discounting nearly one hundred years of earnings. (Actually it surpassed one hundred years of discounting some months ago) That is a massive bubble never before seen in such a broad index of stocks. Ever. Not in 1792 (The founding of the NYSE), 1929, 2008 or anywhere in between.

Overlaid on the chart of the Russell in black is the yield of the ten year Treasury. Notice that the Russell and ten year interest rate (or the diminishing long-short interest rate spread) is moving in tandem or the two data points are correlated. That is because small cap stocks are much more sensitive to the credit cycle. Which means if this trend continues, the Russell’s going to be discounting a lot more than 100 years of earnings at these levels.

The Russell is essentially in a range of fourth quarter 2013 levels while about six of thirty Dow stocks hit new highs and propel that index to new highs. This isn’t good news if this continues. 1) That ten year rates are falling substantially as GDP turns negative. And, 2) that small caps are following interest rates downward. Someone thinks there is possible trouble ahead. Duh! Over the last week someone or a group of someones is trying to rally the Russell and keep it from making a lower high and lower low, which would possibly point to a major change in trend. So, can they manipulate the index higher with Treasury rates headed the opposite direction? I guess we are going to find out. Bubbles can always get bigger as the Federal Reserve and Wall Street has taught Americans time and again since 1913.

Market internals are weak but not that weak. So, some type of major market down draft may not be immediately imminent, but the markets are starting to flash strong warning signs. This when the investor class is wildly bullish, banks are throwing free money out the window, China is trying to reign in excessive speculative growth, the Fed is trying to taper their easing, housing is hitting major snags, GDP just turned negative, last month’s employment report was negative, corporations are reporting the biggest profit warning in history, oil market manipulators are wildly bullish in their futures positions, YOY farm land values just turned negative for the first time since the collapse and private equity and M&A activity has once again entered the complete insanity zone.

But the Whitehouse shows you a chart where first quarter temperature was well below normal as the culprit. It seems they want to have their cake and eat it too. First the temperature is too hot and now it’s too cold. Baby Bear says his porridge is just right. Just right not for the mythical Goldilocks future that political dunces wish us to believe but for a coming economic slowdown with the real unemployment rate already at nearly 25%. This should be really fun.

After five years of massive state deficit spending and tens of trillions of dollars pissed down the legs of central banking buffoons, this is our economic recovery? No. This is what they system is willing to do to save itself. That is, spend unlimited sums of other people’s money to bail itself out without a care in the world for those other people. Another asset bubble, mounds more debt, mounds more government red tape, mounds more wards of the state created and on and on. Baby Bear says it tastes more like gruel forced down his gullet through state violence than any just-right porridge.

<< Home