Financial Market Update

I have really gotten away from a lot of financial market analysis this year. I have written so many financial posts, where we are in the financial cycle and anticipated outcomes that I have decided to focus on more core drivers that are fundamental to this socioeconomic system of corporate and class-based control.

I will state that what I believe are my most interesting financial posts are yet to come. Many of these are esoteric and complex topics I don’t want to get into here. As noted many times, the 2008 crisis would ultimately expose a global volatility that involves all corners of the globe in an economic crisis. Something just a handful of years ago would have had me laughed out of any discussion from either bull or bear. Everyone believed the U.S. was headed for the scrap heap and the world would continue on without a hiccup. Eight years ago I wrote that the entire world would literally shutter and shake when this cycle ends. People are now getting a glimpse of how powerful this cycle truly is. Additionally, the U.S. empire is awesome and well more powerful than any analysis I have yet seen. Well more powerful. As noted on here in past posts, the U.S. is responsible for at least $50 trillion in annual trade. The real number is probably substantially higher. Nibblings of trade settlement excluding the dollar around the fringe by China, Russia and others are just that. Nibblings. They are important, and I wrote that we would likely have a trade settlement crisis this cycle, and that nations would likely move towards direct trade settlement, both well before anyone else I am aware of, but I am dubious that these nibblings will be the cause. You will appreciate the scope and scale of empire at some future point in my writings. And when you realize how large empire truly is, you will appreciate what lengths it will go to in order to keep it. The United States is in a state of permanent war with the world. That war is social, economic and military. And it is fought on countless fronts through corporate and political forces.

For today, I want to focus on some generally-available data rather than anything proprietary. I have shut down my proprietary trading system with the passing of the late Scorpio (November) 2013 turn date. I don’t know if my shutdown is forever but for now it is. Those who think they can be “cute” and beat this system are deluding themselves and don’t have an appreciation for what is actually happening nor how quickly future events will metastasize. The last time I made a similar statement was back within a few percentage points of the all-time highs of major U.S. banks. I wrote that I had moved all of my money and family’s money out of Wall Street banks. This system is so wildly corrupt and the bubble so large that I suspect I will never again own another financially-traded asset. That is, if I even have any money of value to do so. That statement is likely to manifest itself in one of two ways. One, the system may collapse completely and money and institutions of capitalism like the stock market and bond market will simply disappear or, two, this system will be replaced with something where the concept of an investor class or financial speculating for personal gain simply disappears. From my work, the risks post November (Scorpio) of 2013 are unprecedented and beyond words in scope and scale. And going into dreaded October with this market sliding, added to this month’s blood moon, could be very dangerous in the short term. Can Wall Street bounce the market upwards again in this month?

October, an often cyclically-unpleasant month for financial markets, is filled with war, economic sanctions, a rapidly imploding Europe, a Russian ruble hitting all-time lows, a China now in the midst of dealing with the biggest capital bubble in history, a dollar rising with strength not seen since the 2008 collapse, multiple large viral and bacterial events and the overarching fold of the largest financial bubble in the history of the world. A financial bubble that is now showing the early signs of liquidity shocks. In addition as I type this, we are now putting a major cycle bottom in an important astrological volatility index that may play a major role in human behavior.

As noted many times over the last few years, the November 2013 turn date was the official kickoff in the coming battle between good and evil. (2013, 2016 and 2022 have been and remain three (two) future dates of concern on here.) I anticipate that global chaos will continue to intensify in waves through 2022, the last of the three important dates discussed on here over the years. (2022 is also the date by which I have noted American empire may disappear. If that happens, the entire world economic system will be in complete chaos.)

I’m not stating we are witnessing the ultimate top in financial assets at this moment. But it appears we are in the process of making a top. The last time I made that statement was fourth quarter of 2012. At that time I wrote that we could see one final and possibly spectacular push higher. But if I am honest, I certainly gave that just about zero chance of happening. But, it did happen. In retrospect, the fourth quarter of 2012 was a top. Just not a top in markets. It was the top in global growth that has been ratcheting down ever since.

The size of the rally in financially-traded assets since 2012 is a barometer for the record amount of “useless” money in the global economy. And, of course, the useless capital-consuming, wealth-robbing, wealth-transferring jobs it creates. In one of his more profoundly ignorant moments, Greenspan would call this a savings glut, as he did many moons ago. What it really is is a record amount of useless money created by criminal and useless financial activity in the global financial system. Just one example of this is the $20 trillion of useless money over the past decade and a half used for mergers and acquisitions in the U.S. alone. A dynamic that served no purpose to a functioning economy, to democracy or to human development. War, the national security state, the militarization of our society, the over production of weapons and on and on probably added another $15 trillion in the U.S. alone. Every nation has its own story to tell in the creation of a massive wall of useless money that now flows around the world like a virus inflating and deflating financial assets courtesy of corporations, politicians and the investor class. ie, Courtesy of pathology.

Financial assets could meander around for months or even the next year. Or we could continue higher. But I wouldn’t bet my life on much positive news for this system post November of 2013. Liquidity is certainly becoming a premium as a rapidly rising dollar and a rapidly declining ruble alerts us. As chaos around the world continues to pick up, the ability of the status quo to control anything, let alone everything, will become even more impossible.

Picking tops is a very esoteric art. I don’t have any of my algorithms or data to analyze the level of detail of what I am used to so I can’t do the type of analysis I am used to. Shorter term, I am certainly concerned. The market is deteriorating broadly and rapidly into October. This year specifically looks like October might provide an astrological “bottom” in what will be rising chaos on earth.

I have talked often about the massive valuations of the Russell 2000, which is discounting nearly one hundred years of earnings. This has never happened in such a broad index. Ever. Not even close. No one in mainstream finance, economics or media will ever talk of this fact for fear of spooking markets and seeing a panic flight out of risk assets. A panic from risk would leave Wall Street holding the bag with the latest monstrosity of their creation. A few weeks ago the Russell 2000 saw the 50 day moving average cross the 200 day moving average. The highlights on CNBC were that this is a “death cross”. Well, I don’t know about that but it does point to declining momentum and possibly declining liquidity. At the same time 10 equity market indices in Europe have also experienced the same slowdown. The German, French, Italian, British, Spanish and five other European exchanges have all seen their major indices experience 50-200 crosses. Europe is deep in crisis and the slowdown in Germany obliterates their last hope of growth. And, it also means that the viability of the euro currency is again going to come front and center without some type of new bailout for Europe’s aristocracy by the ECB. Contrary to popular opinion with many, European culture is the “Ebola” virus that infects the U.S. and not vice versa. The Quakers did not flee Europe to come to the shithole of class, corporate power, aristocracy and state power that now infects the U.S. They fled Europe for those very reasons. That virus now infects the United States in spades.

Remember that money is fungible. That means the S&P 500 bubble, the art bubble, the housing bubble, the high-end real estate bubble, the farmland bubble, the private equity bubble, the investor class bubble, the concentration of wealth bubble, the money bubble, the university bubble, the entertainment-leisure-sports bubble, the financialized economy bubble, the MBA bubble, the China bubble, the emerging markets bubble, the commodities bubble, the money-in-politics bubble, the lawyer bubble, the lobbyist bubble, the mainstream media bubble, the social media bubble, the advertising bubble, the Apple bubble, the high-yield debt bubble, the consumerism bubble, the gold bubble, the military-industrial complex bubble, the investment advisor bubble, the hedge fund bubble, the corporate power bubble, the M&A bubble, the Washington power bubble, the American empire bubble, the industrial food bubble, the debt bubble and every other bubble created through Wall Street and Washington violence, (and that have all been talked of on here ad nauseam) are all comparatively equal in scope and scale. They are proportionately as large as the poverty bubbles you see in the U.S. We know this because money is fungible. That means just because you don’t see the scope and scale of these bubbles as measured by mainstream in-the-bubble metrics doesn’t mean they aren’t comparable. And, you may not see these bubbles because in some way you are the bubble. But I’ll share some detailed analysis in the future that will reveal the S&P 500 and many of these other markets are just as big of a bubble as the Russell 2000. In other words, hundred year bubbles. Which, by the way, shouldn’t surprise anyone because the Federal Reserve, the enabler of the criminalized aristocratic society, corporate capitalism and the state, is one hundred years old.

In writing that last paragraph I am reminded of a quote from a favorite movie, Gladiator. “We shall go to Rome together and have bloody adventures. And the great whore will suckle us until we are fat and happy and can suckle no more.” The aforementioned bubbles were created by the state for the benefit state actors. And they were created by suckling on the great whore of empire. Just like the Roman Empire.

The first chart I want to share is the dollar against the Chilean peso. Chile is the world’s largest producer of copper as noted on here in past posts. This graphic is confirming what has been written of quite a few times in the last year. That is, the world’s demand for copper is, and will likely continue to be, under great pressure. Copper is a bellwether to both industrial and consumer-based economic activity. But, it is more importantly a bellwether for capitalism.

The next graphic is the dollar against the Russian ruble. Economic sanctions are biting the ruble hard. And, that means the Russian economy is probably in much worse shape than anyone outside of Russia can imagine. Remember, the last time we saw any type of sanctions, it was some years ago against Iran. While those sanctions were more severe, these sanctions are both in euros, pounds and dollars which comprise almost the entirety of global trade. Iran saw its currency fall by about 70% as I recall from memory. A similar situation in Russia could and would create unintended consequences both inside and outside of Russia. Iran weathered its sanctions. There was no end-of-the-world for Iran. Russia may as well. But, it could experience massive monetary dislocations and even see Putin sacked as a result. Russia’s state actors may have viewed what happened in Iran as a barometer of its own fate. ie, That it could weather the storm. We shall see.

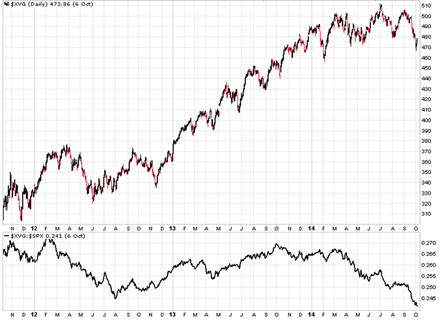

The last two charts are a three and one year look at the Value Line Index. This index has been around for a long time but is not typically part of the mainstream lexicon. It is a broad, equally-weighted index of nearly two thousand stocks. This is very unique because indices are generally weighted. So, the VLI gives us a view as to what is happening across a multitude of stocks without having to delve into detailed analysis of market data. We see that this index captured a mass move into equities in 2013. This is obviously from many sources including trillions in corporate share buybacks, sovereign wealth funds, free money from the Federal Reserve, greater margin debt, buying by central banks around the world, Wall Street, repatriation of hot money into dollars from the rest of the world and on and on. But we see that liquidity has been evaporating essentially since Scorpio or November of 2013. Coincidence? We shall find out soon enough. But the index is and has been lagging weighted indices like the Dow and S&P 500. So, we have had an indication for some time that overall weakness in financial assets was coming. Below, the chart of VLI price is a measure of the Value Line Index divided by the S&P 500 in black. We see that the weakening of the VLI comparative to the S&P has portended overall market weakness for the past three years. In prior decades this weakness may not imply anything. But, in today’s world of algorithmic trading, it means a lot. Because baskets of stocks are bought by computers rather than any type of individual analysis and selection of particular equities. I suspect this is a very good measure of how market liquidity is now literally collapsing as the VLI/SP500 relative strength is hitting new cycle lows. I don’t see any recovery in liquidity as possible now that all of this useless, hot money is fully invested. That is, unless central bankers and politicians can dream up another new scheme to flood the world with even more useless money.

If you want a simple barometer to watch for market liquidity, the relative strength of the Value Line Index comparative to the S&P 500 is as good as any.

A closer look at more recent action by the VLI. Lower high and lower low in this most recent rally and decline. Not a good sign.

Markets move in waves and cycles. So, eventually the dollar may weaken as trades become crowded. Or not. We just don’t know. We haven’t seen anything like this environment in history. Where there is so much useless money around the world seeking paper returns in lieu of actual investment and production. But one thing is quite certain. We are going to see a lot of money vanquished. All of this useless central-bank-created money is headed to money heaven at some point. And that’s bad news for all of the bubbles it has created. Because that means the supply of money that has created all of these bubbles will no longer exist. Isn’t that all the inflation and deflation of a bubble really is? A mismatch of supply and demand?

My long-time downside target remains 200-450 on the S&P 500. That is, if the stock market and capitalism even survive. The longer this cycle goes, the greater the chances that the outcome will be well-more horrific than imagined. Because the greater the violence the state is creating through its unintended consequences of the status quo trying to sustain itself.

<< Home