Friday, June 30, 2006

But The Market PE Is So Cheap!

First off, I have to say that I try to practice the mindset that I am neither bullish nor bearish on stocks or the economy. ie, I am open to change and not tied to a particular point of view. Those who point to massive debt or point to overspending by consumers as a reason to think stocks are going down simply to not have historical precedence on their side. Some of the biggest moves in the stock market have been when America had massive debt burdens. Much higher as a percent of GDP than today. The likely reasoning behind that fact is the worst may be behind us at those moments. People see accumulated trends, either positive or negative, and believe they will continue forever and they never do. Another data point is the stock market had a 400% rally in the Great Depression. So, today, just as people label Americans as spendaholics, we are most likely to become a nation of savers over the coming years. That may start out as a trend of spending less rather than sticking money in our mattresses starting tomorrow.

Are the markets cheap? I guess that depends on perspective. Are they cheap compared to six years ago? Yes? Compared to ten years ago? Maybe. Compared to fifteen years ago? Not as. Compared to the last one hundred years. Nope. The problem is that people develop these mindsets over periods of economic prosperity that are simply not sustainable. The trend never lasts forever. But, people say there is so much liquidity today or so much money chasing stocks or the world is a different place than fifty years ago. Maybe. But, do you realize that fifty years ago they were saying the same thing? That was their golden age of technology, economic growth, great wealth and enlightenment. One constant is human behavior. That never changes. And neither does the attempted rationalization as to why things are different this time. That is why the stock market never changes.

So, in the last four years, what has happened to the stock market PE ratio? It has contracted. Not only here but in nearly every major stock market around the world. When Wall Street is bullish about the future of the economy, stock market PEs around the globe expand along with earnings. The rationale for this is that people are much more confident about the future and are willing to pay a higher multiple for stocks so PE's expand along with earnings. This time earnings have expanded but PE ratios have contracted. Historically, this is a very ominous sign for stocks. It means investors are not confident about the future so they are willing to pay less for a stock.

So, is this cycle of growth in stock prices sustainable? Is the market cheap? Well, earnings are the most cyclical in the last fifty years. Now, what does that mean? That many of the company earnings propping up the stock market are highly cyclical or in simple english, their earnings are like a yo-yo. They go up alot then come down alot. Hence cyclical. So, now that they have gone up alot, what have they done historically? You may fill in the blank yourself.

So, if earnings start to decline, will the PE ratio be 38 on the Russell 2000 or 17 on the S&P 500? No, the PE will rise as earnings fall. Historically, whenever earnings fall and PEs rise because of that, stocks fall because they are overvalued. So, is the market cheap? Compared to 2000, it's very cheap. What's the old saying? Those who don't heed history are doomed to repeat it?

Wednesday, June 28, 2006

What About Commodities As An Investment?

After shares of Rio Tinto and BHP recently lost 20% of their value in a quick and nasty correction in metals, Merrill is recommending weakness as a buying opportunity saying there is a 60% chance metals extend their rally over the coming decade, a 30% chance shares will fall further in coming months and a 10% chance shares will make news highs in the next three months. Well, that adds up to 100%. But, I want to know how those percentages were calculated and what they were based on. Anyone who can predict the future with that much accuracy needs to buy me a few lottery tickets.

Then there's this. Citigroup said that investments in global commodity funds were around $200bn in February. For some time, Citigroup Smith Barney analyst Alan Heap had made out a case that speculators, not least hedge funds, had been key drivers in pushing metal and commodity prices to multi-decade highs. At the end of January this year, Citigroup warned loudly that “a flood of investment funds are driving base metal prices much higher than can be supported by fundamental analysis of supply and demand. It’s a bubble which could grow a lot bigger before bursting”. Noting that fund investments began to surge in early 2004, Citigroup illustrated how commodity markets “have always been strongly influenced by speculation”.

So, which is it? Is Citigroup analyst Hill or Heap correct? Or is Merrill correct? Why are different Citigroup analysts saying different things?

Or maybe Alan Heap is changing his mind again. Heap estimates that funds have invested more than $US200 billion ($263.4 billion) in commodities, up from less than $US10 billion

a decade ago. Here Heap also says it is a "stronger for longer" boom, a "supercycle," according to Alan Heap, commodity analyst with Citigroup.

So, let me get this straight. We are in a metals supercycle. Global synchronized growth is going to propel the price of industrial metals for ten to twenty years? So, copper seems to be the favorite for all of these metal lovers. I have the copper chart for the past 100 years. It just has never happened. Since 1960 every single economic cycle has started with copper at 60cents a pound or less. We've had these periods before where global growth has pushed the price of copper astronomically higher. Five times in one hundred years. All five ended with copper cratering after one business cycle. Yet, I am to believe a Wall Street expert that this is going to go on for twenty years? Copper went from 60cent at the beginning of this cycle to over $4 this year. Yet, even at $4 a pound people were calling it higher. Now picking the top can be difficult but how much higher? Higher than the price of silver, a precious metal?

Remember Wall Street is always wrong eventually. The key is to follow them until they realize they were irrational or wrong. Then bail when they bail. That is easier said than done for most investors. But, failing to take profits in sectors or stocks that are highly momentum driven will eventually cause tremendous wealth destruction for those who decide to buy and hold. Ok, let's be rational for a moment. Copper reached levels in 2006 that were nearly as expensive as the price of silver at times in history. It has seen a rate of change increase that has never been matched in the last 100 years. Silver is a precious metal which has limited availability. Copper is is a highly abundant resource that you make housing wire with. Ditto with iron ore, aluminum, nickel, tin, lead, etc. All of these metals have made incredible moves to the upside.

Let's look at some fundamentals. China is supposedly the driver for the metals boom. Their growing economy is using all of the metal the world can produce. Or is it? That's what we are told. Yet, China has been growing for two decades. So, why did metals start to rise right around the time the stock market bubble was being created in 2000? Well, for that matter, let's apply the same logic to oil. Oil was $10 a barrel right as the equity bubble was coming to a top.

Two things converged at that time to make these assets a worthwhile investment. 1) New mining and exploration had not taken place in quite some time. When commodities become undervalued over a period of years, there's no incentive to look for new sources or mine new product. ie, When oil is at $10 a barrel, why would an oil company drill for more product? There's no profit. So, what then happens is eventually global economic growth will drive demand for any commodity. Demand drives up the price. As the price rises, commodity company profits increase and those profits can be used to add mining or exploration capacity. Now, with oil at $30 or $40 or whatever, it becomes economically viable to search for more oil. Eventually, if demand becomes so great, the price continues to rise until demand is choked off. ie, At some price demand will abate because price itself becomes too much to absorb thus causing some type of slow down. Why a slow down? Because commodities are inputs to economic growth. They are used to make "stuff". Eventually as input costs rise, companies using these products must either raise prices or see their profits erode. Raising prices causes inflation and that makes central bankers very unhappy so they start raising interest rates. This starts the cycle of an economic slow down. I'm obviously simplifying this for the sake of not typing ad infinitum.

ie, Those who believe copper or oil can continue to go up for ten or twenty years in a super cycle are not economists. They are Wall Street "experts" who fail to realize the concept of a supercycle is ridiculous. If we have seen oil and copper go up for a handful of years and we see prices continue to go up for another fifteen years, we'll be paying $20 a pound for copper and $300 a barrell for oil. (Arbitrary numbers chosen to make a point.) Global economies will bust or are already busting because these prices are already causing economic problems. The concept is just plain stupid and there is zero historical precedence for it because in every other historical cycle, rising commodity prices destroyed the global economies. And that has either or will eventually happen again.

So, you may ask, well, what if commodities come down in price? Will we continue to have global economic growth? Well, that is surely plausible and possible. But, again there is no historical precedence for it. Why? This is point number two from above. 2) This is where Wall Street's role comes in. You see, if commodity prices were really going up only because of China or global growth, the price of oil and copper would have started to rise as China's demand started to build ten or twenty years ago. But, they didn't. Instead, they started going up just as the equity bubble was coming to an end. What is really driving commodities? Global growth is playing a role. But, what is pushing commodities to levels of a likely bubble? Wall Street. First, you need to understand how global investors work. Be it hedge funds, mutual funds, finance firms, professional traders, individual investors or whatever. There is massive pool of investment monies. These monies move from investment to investment over long cycles. They drive an investment higher and higher until it can be driven no higher (stocks in 2000.), then they look for the most undervalued investment to move to next. And on and on and on. And, there are times when there is so much global money available they drive and drive investments until we have bubbles. So, what was the cheapest investment in 2000 after they blew up stocks? Commodities that had been ignored for a decade or more. There are more traders trading oil, copper and other commodities than at any time in history. And, they are making billions upon billions of profits by driving these commodities prices up. Not only that, but they are courting retirement funds, pension funds and individual investors and telling them all it is different this time. That these assets are going up, up and away. So, can someone tell me how a person in India or China making $7 a day can afford copper at $4 or $20 or whatever a pound? Or gasoline at $4, 10 or 15 a gallon? Prices will eventually kill global growth. And, you can thank your favorite Wall Street firm because many are killing the global economies in the name of profits.

So, now you know the answer to the question of "will the global economies continue to grow if commodities come down in price?". From a historical perspective, the answer is the fast money won't quit riding these investments higher until they bust the global economies. And, when they do, pension funds, individual investors, hedge funds and others who thought prices could go up forever, will lose tremendous amounts of money. That is why there is zero historical precedence for a supercycle of commodities. It's a self regulating environment. Higher prices cause commodity companies to invest in more production. Eventually higher prices choke off economic growth just about the time more production of copper, nickel, tin, oil or whatever hits the market. So, with demand decreasing due to higher prices, the world now has much more capacity to product more commodities and you eventually have a commodity glut. Supply & demand. Or in the case of commodities............Boom. Bust.

Could it be different this time? Well, Freeport McMoran, a major copper producer said in 2006 it cost them 7 cents to mine copper. Copper was over $4 a month ago. Do you think these prices are rational? Are they being driven by fundamentals? I wouldn't bet my checkbook on it.

UPDATE ON JUNE 30th

Today, traders are at it again. It appears that the data on the economy is ambiguous at best giving commodity traders reason to believe economic growth is unaffected by their actions. Comments from professional commodities traders were again turning bullish. As long as the economy continues to do well or there is any inkling of such, they will continue to remain fascinated by input commodities as a new investment class thus continuing their drive to push energy and industrial commodities upward. This action will surely guarantee a self fulfilling economic slow down caused in large part by their actions. ie, Higher prices will eventually choke off demand and cause central banks to continue to raise interest rates thus killing the American consumer.

Behaviorally, it would take a change in trader's psychology that will only be permanent when they realize they were wrong and input commodities are not an investment that is sustainable. ie, A popping of the economy and along with it a popping of demand for input commodities will likely be needed to stop their bullishness. So, my suspicions are confirmed and it appears they will attempt to push energy and industrial commodities higher from here. In the end, whether the economy is cratering yet or whether it will just be an eventuality, we will all be punished.

Monday, June 26, 2006

Follow Up On Sentiment

It is not a good sign that investor sentiment is so negative just a month removed from four year highs in international and American equities. Another point to ponder is the University of Michigan Consumer Sentiment Survey courtesy of the Federal Reserve Bank. What is interesting though is that this survey was published before the stock markets started to fall. It was published on April 1, 2006. So, what did the consumer think with the stock market at four year highs? "Current conditions" had the biggest one month decline in the history of the survey. That is nearly thirty years. Given the consumer drives two thirds of the American economy, what does this mean? It's no guarantee but it might mean the consumer is underemployed or accumulating alot of debt or is being hurt by energy or is worried about their housing values. If any or all of these are the case, could consumers start to spend less and as a result slow the economy?

Notice the darkened horizontal lines. They are times of recession overlaid on the Michigan Sentiment Survey chart. Again, clicking on the chart will give you a larger view.

General Motors

Those two words draw up images that likely cause Alfred Sloan to roll over in his grave. What do I think of when I think of GM? The worst management this side of the Berlin Wall. Cars only rivaled by those made in the former Soviet Union in their ugliness and, at times, quality. Three of GM's finest are pictured above. The Buick Roadmaster wagon, the Pontiac Aztek and the Cadillac Cimarron. One from the 80s, one from the 90s and one from this decade. Three of many cars that should be are a total embarrassment. The utterance of General Motors used to cause fear in every corner of the globe. A dominant empire and sign of America's technological and manufacturing might.

What happened? In a nutshell, they were insulated from competition and truly did become something akin to the monolithic car makers of the Eastern Bloc. The high volume automobile business is not something which has historically drawn alot of new competition. The engineering, plant, dealership and capital equipment costs are mind boggling. The cost of developing a single new platform can be as high as $3-4 billion dollars. General Motors, Toyota, Ford, Volkswagon, Honda and others cumulatively spend so much money in new product development that it is mind boggling. Large companies launching 10-20 new or refreshed designs a year on a global basis requires some serious cash. GM, as an example, has nearly $300 billion in debt and before the recent rise of its stock, its market capitalization was about $9 billion. You want to buy GM? No problem. You want $300 billion in debt to go with those fries? You want to enter the high volume automobile business? No problem. Got a cool fifty billion to bet on chance? The Japanese, Korean and Chinese government did. Frankly, that is how all of the Asian automakers got started. Government cash and government protection.

The timeline of events at GM over the last forty years started with greater than 60% market share in the US. Now, it is less than 25% and much of that is fleet sales, government purchases, rental car purchases, supplier employees, families of GM employers who get a discount, GM employee purchases and GM retiree purchases. So, how many new cars does GM actually sell without these highly discounted sales? Nobody but GM really knows but it's an ugly picture.

GM first ceded the small car market believing they could move upscale and let the Japanese build low profit small cars. Soon, it was apparent the Japanese were using small car profits to fund designs of larger cars. So, GM decided they would modernize. Robots, robots and more robots. One of the worst CEOs in American history, Roger Smith, spent something like $60 billion modernizing GM to compete with Toyota. Instead of spending that money to modernize, GM could have bought Toyota, Honda and Nissan for that same amount of money. And, what did we get for that investment? Well, I had a buddy who worked at the GM Hamtramck plant where robots were to do everything including each Toyota's lunch. The end result was robots welding other robots and GM ripping much of the automation out. When this didn't fail to stop the market share losses, GM decided it would get into other businesses so it bought EDS and then Hughes Aircraft. But, the market share losses didn't stop and GM found out building missiles wasn't the same as building cars.

So, we've seen GM retreat from market after market as the small Japanese manufacturers used profits and superior quality to move from subcompacts to compacts to midsize to luxury to sport utility to pickups. All the while, GM's market share dropped from 60% to about 24% today. Of that 24%, how many sales are to auto rental businesses and to GM employees, supplier employees, dealership employees, family of GM workers, etc. Does GM actually sell anything to someone not affiliated with GM? If that isn't enough, GM bet its business on SUVs and full size pickups AFTER the attack of 9/11. No thought was given to hybrids, moving up small car or midsize car programs with better gas mileage or any thought that oil, at $10 a barrel would rise due to global demand or risk now baked into the terrorist dilemma.

And, for all of this, GM executives have made billions and billions in compensation over the last thirty years while GM has gone from being the biggest employer in the US with over one million employees (going from memory) to less than 150,000 US employees today. GM is attempting to cut its way to prosperity. Maybe GM can finally compete with bold and innovative designs when they no longer have any employees. At this rate, it shouldn't be too much longer before we find out if that is the case. GM now complains healthcare costs account for $1500 per vehicle. Yet, if they would have maintained their market share, it would be $650 per vehicle. How much is it for Daimler or Honda? I don't know but it isn't zero whether it be the cost of national health care in Germany or Japan or healthcare costs for their US employees. Let's say it's $500. So, even with a $1000 higher cost per vehicle today, you mean to tell me GM can't differentiate their cars with innovative products are superior designs such that a consumer would be willing to pay $24,ooo for a breathtaking GM design versus $23,000 for a ho-hum competitive design? If so, GM needs a new marketing team. But, first they need more aggressive and bold risk taking with their designs. GM must not be as good as the competition, they must be better or they will never get a satisfied Honda or Toyota customer to consider a GM product.

The automobile industry isn't exactly known for its innovation. We still have transportation with four rubber tires, four doors and a relatively crude drivetrain after one hundred years. Auto manufacturers are nearly impossible to kill off because they have historically been shielded from alot of competition. For most of GM's history, there were only a couple of companies which competed with it. So, GM shoved whatever kind of garbage out the door they saw fit. And, as a consumer with limited choices, you ate it or you didn't eat anything at all. While barriers to entry are still high, that began to change significantly about thirty years ago. Now there are twenty major manufacturers vying for your spend and GM has lost market share nearly every year during that period of time. An unimaginable but true statistic. If this happened in any other industry, GM would already have gone the way of the Dodo bird. ie, Extinct. If GM had the market share of thirty years ago, it would be a half a trillion dollar company and still the mightiest company on the planet. Instead, today, it is a declawed, whimpering shadow of its former self. Yet, inside of GM, the arrogance continued during this period of time. That arrogance has led to a crisis which will likely be resolved in only one outcome. Bankruptcy. Regardless of what GM does, they are now saddled with a retiree burden which is likely unsolvable without a massive restructuring of those agreements. Did it need to be this way? Of course not. But it is and that is all that matters.

I actually worked for GM as an engineering co-op in college and am an avid automobile enthusiast who hopes for the day GM gets its act together. During my stint, only the best could dream of working for GM. Well, except for co-ops which explains my situation. lol. In fact, GM had their own technical college, GMI, which was one of the most prestigious engineering schools in the world and extremely difficult to get into. Today, it no longer is affiliated with GM and thus the prestige and reputation have diminished. It is now Kettering University. At one time, its reputation was akin to MIT or Stanford as a degree from GMI held significant weight regardless of where you worked.

Let's look at innovation. General Motors has spent more money on R&D in the last twenty years than America spent developing whole new technologies and whole new industries in the Apollo moon program. Much of everything you touch today was influenced by advances in the Apollo program. I can honestly say that was one government program that significant commercial benefits to American companies and consumers. So, America's entire investment for the Apollo program was approximately $100 billion. Last year GM spent $7 billion on research and development. So, for hundreds of billions in R&D we get cars with fuel efficiency 5-15mpg better than they were during the OPEC oil crisis of the 1970s. A 5.7 liter V8 truck gets a combined 14 miles per gallon today. In 1974 it was 10mpg. The Chevy Chevette got nearly 30mpg in 1975. Today, the Chevy Aveo gets a combined 30mpg. What gives? You mean to tell me $7 billion in R&D last year and GM cannot produce a car with better powertrain technology?

Let's be fair. Honda, BMW, Daimler, Toyota and others aren't much better. Innovation and the automobile industry is pretty much mutually exclusive. Yes, engines burn cleaner. Yes, smaller engines develop more horsepower. Yes, we have better creature comforts. Yes, the quality has improved substantially. But real innovation, especially in power trains? Fuggedaboutit. So, why didn't GM or Toyota come up with this twenty years ago? They will tell you it was because customers didn't want it. Or because there was no demand for it. We could argue to the cows come home but new industries, ideas and products are created daily which have no existing demand. Latent demand is everywhere. You don't know you need something until it is invented. Did you say you needed Google before its invention? The auto industry is highly resistant to change and spends millions lobbying your government to make sure it stays that way.

Yet, we are likely to see a huge change in the automobile business. It will not be led by GM, Toyota or other traditional manufacturers. They will profit from it but the leaders will be entrepreneurs, small flexible startups, innovation companies, university researchers and government led efforts at transformational change. I tend to think of it as a mini-revolution in transportation technology. It is not predicated on the high price of oil. The problem has been defined and that is the starting point for invention. The problem is energy independence so we don't have to spend $1 trillion on another Iraq War defending oil or $80 billion a year meddling in Middle East politics and it is a new awareness our gluttony is destroying the planet and if we want a better place for our children we need to get our shit together. By the time it is all said and done, we may even be presented with many new transportation manufacturers. With advances in productivity, design capabilities, off the shelf componentry and flexible manufacturing technology, it is conceivable boutique transportation manufacturers could be profitable with relatively low run rates. Today there is even a small American company which can retrofit a pickup to achieve 85 miles per hour top speed and 120 miles before charge and using Lithium Ion battery technology, can recharge the system in ten minutes. All for a vehicle cost of $40,000. How low could that price be driven in volume by Toyota or GM? Why is this important? Our electricity can be derived from clean coal technologies, natural gas and nuclear power which does not come from unstable regions. ie, Electricity powered or assisted cars can help achieve energy independence and the battery and energy storage technology is making rapid advances.

What must GM do to be successful in its turnaround efforts? Well, more than I care to type but here are a few major areas GM must focus on.

1.) GM has lost entire generations of customers. Those customers may never come back. GM needs to focus on the genXers as Toyota and Honda focused on the baby boomers. Studies have shown young kids have a positive opinion of GM. Yet, what do they offer that a genXer wants? A Suburban? A Cadillac DeVille? Does GM even know who its customers are? Anyone who pays Tiger Woods big bucks to be a spokesman for Buick, a car purchased by 70 year old men, doesn't get it. Do you think Tiger Woods drives a Buick Rendezvous? I don't care if Buick drivers play golf. GenXer Tiger Woods fans or yuppie Tiger Woods fans don't drive Buicks. Bold Cadillac V-Series or trimmed out Escalades? Yes. Buick? NO. Tiger Woods would drive a 500 horsepower Escalade or V-Series. And, just as his arrangement with TAG Heuer, Tiger Woods could be a boon to GM if used properly.

2) GM needs bold and innovative designs. Robert Lutz was brought in as Vice Chair to get GM back on track with bold and successful designs. To date Lutz has failed. Not because his designs are not significantly improved but because they are too staid. There are signs of life with the Solstice, Aura, Cadillacs and coming pickups but the majority of GM designs aren't even best in class let alone good enough to maintain market share.

3) GM needs to upgrade its interiors. GM interiors are the worst in the business. Some of the new designs are drastically better but they simply are not competitive with best in class as of yet except for the Cadillacs.

4) GM needs to build better relationships with its suppliers. GM has abused suppliers so long that in times such as today, suppliers are not willing to extend GM much leniency. Purchasing in the auto industry is by far the biggest expense and cost controls are extremely important but GM working as a partner with suppliers as opposed to an adversary will yield long term benefits for both. Partnering, GM actually has the ability to think more strategically with a partner and, if necessary, help their suppliers improve their efficiencies through common business processes, integrated design methodologies and shared technological/productivity advances.

5) GM must find every possible means to cut costs, conserve cash and share common platforms globally. Today, GM simply does not have the cash to spend on new development that some of the more healthy competitors have. This may actually act to quicken the demise of GM if they cannot keep their designs new and fresh while others are able.

6) GM needs to find a way to use their global design and engineering centers of excellence more effectively. Today GM is building small car expertise in one region, pickups in another and midrange offerings in another as examples. Instead GM needs to find a way to have Asian, European and American engineering teams working effectively un unison on the same design. A twenty four hour cycle of development. ie, Should development work be done on a next generation product in the US, it will be done in eight hour days. Should engineering be shared by a global team, work could be done in Asia, then as the sun sets, work is started in Europe then the US. Development is done on a 24 hour a day basis which speeds innovation and drives the competitive advantage few other car companies have.

7) GM needs to rebuild faith in its brand within the US. Whether this is done with extended warranties, by improved dealer experiences, a transformation of how it services customers or by direct marketing is irrelevant. GM needs an all encompassing full court press on the American consumer and it should start now.

8) GM should be the innovation leader in next generation transportation technology. GM is a powerhouse of technology, creativity and brain power that simply needs unleashing. GM is surely capable of driving new technology into the market place before anyone else. Whether that be hybrids, clean diesel technology, safety, the driver experience or efficiency. Innovation in itself would do much to transform GM's brand images.

9) GM must develop a culture of risk taking, responsibility and empowerment. GM has "big company disease". A common ailment that is usually rectified by active boards or shareholders or competition which forces change. A company in such a staid industry has been able to survive for forty years with no focus and nearly total apathy. GM is internally focused, has no idea who its customers are and has no sense of urgency. It uses its heft to maintain its existence rather than innovation, quality or breathtaking designs. That is why, forty years later, companies such as Nissan, Honda and Toyota now rival GM in global scale and size. They, on the other hand, have been consumer focused and maniacal about winning in the market.

10) GM must define its brands and who its customers are. I look at some of these products rolling out of GM and wonder who are they targeting. First off, no one in their 20s. Most in their 50s, 60s or even 70s. After dominating the luxury segment, GM has all but forfeited that arena to a dozen manufacturers. What are my choices if I'm 35, single, well heeled and want a sporty car? A Grand Prix? A Buick Lucerne? A Chevy Malibu? Huh? What if I'm 25 and want something that is a reflection of my youthful independence or individuality? My point is that GM has not had a cohesive brand management strategy in forty years.

There is much more GM needs to do but the customer experience is the most important focus for GM. Whether that is pre-sale, post-sale or as part of ownership experience.

It has yet to be determined whether GM has reached the threshold of pain necessary for its revival but if this is not the time it soon will come. One thing I am certain of. When the pain is severe enough, GM will finally emerge as a formidable foe. Crisis creates opportunity and brings about change which otherwise is not possible. As difficult as it may be to fathom, GM will once again drive fear into all those who dare to cross paths with The General. The only question is if Rick Wagoner or another will be the one able to deliver the goods.

Saturday, June 24, 2006

Wall Street Learns Nothing And Forgets Everything

http://tinyurl.com/ganjd

So, why do I use this as the title of my post? First, it is important to understand Wall Street is always wrong eventually. That fact cost equity investors $13 trillion globally in the 2000 bubble. Secondly, because it appears Wall Street is currently experiencing a bout of amnesia. Thirdly, once again it appears Wall Street has not learned from their prior mistakes.

I've been writing about industrial commodity bubbles for six months and it reached a crescendo at the end of the first quarter when we watched commodities explode in a final blow off rally. A rally that was likely fueled by the incompetent move to raise rates by the Chinese central bank. Unfortunately, the Chinese central bank left the savings interest rate the same while raising rates. So, incredibly this act incented Chinese banks to wrecklessly increase their already foolish lending practices. (Loan out accumulated savings deposits with a larger profit spread.) So, as we found out a few weeks ago, lending actually exploded by over 31% year over year into already overheating real estate and industrial sector bubbles. The Chinese Politburo has totally lost control of their economy in a big way.

Historically, bubbles typically come in pairs. There's actually a rational reason for this irrational behavior. The first bubble happens at the end of a long cycle of tremendous wealth building and extreme levels of crowd enthusiasm. Once that bubble is popped, the wealth that isn't lost in the first bubble looks for a home in the most undervalued assets to create the second bubble. All that is needed to create this second bubble is cooperation by central bankers which we got by lowering rates to 1% post 2000. Think of it as locusts going from field to field, leaving destruction in their wake. Everyone is obviously aware of the first bubble, it was the equity bubble in 2000 led by large cap and large cap tech in the US. The second bubble has been in hard assets including oil, industrial metals, real estate, the associated asset stocks and equity markets in countries whose economies are driven by hard assets such as Russia, Brazil, Saudi Arabia, Dubai, etc. By the way, although it may be obvious from my statements, this is a massive global asset bubble.

So, let's play a game. It's a visual game. You get to guess what these charts are. The text is too small to tell but if you click on the charts individually, they will blow up to the point where you can read the company name, the dates and the prices. Care to guess? The answers are below the graphs.

All charts are courtesy of the wonderful site Prophet.net. You may click on the individual charts to get a larger view.

The first chart is the of the stock market bubble of 1929. The chart to its right is the Nasdaq 100 bubble in 2000. The next four charts are of the Brazilian Stock Market, Toll Brothers home builder, Phelps Dodge a copper producer and Titanium Metals. THESE CHARTS ARE FROM TODAY! (I cut off the last few months of Toll Brothers to show the six years of comparison. It is not a good sign that the stock is already down over 50%. My work argues a decline of 80+%) I randomly picked these charts. The charts from other industrial metals, miners, transports, energy stocks and real estate stocks are all very similar.

Oh, and what is the final chart? That is the price of the Nasdaq 100 after the bubble burst. So, which charts look worse? The ones from 1929 and 2000? Or the charts from 2006? As far as price appreciation, it's the 2006 charts. All charts are six years in length to give equally fair comparison. Notice how the stocks were languishing then exploded into the prices of today. Crowd mania. Group behavior. Stupidity intensified. So, are these bubbles? Or will things be different this time? Do these charts inspire confidence we are going to have a great 2006 for equities or a great economy going forward? How about 2007? Will these stocks continue to rise to the moon? Is it a goldilocks global economic environment? Watch these stocks or the other stocks in the same industries. They hold the future for equities and the global synchronized boom.

In closing, a few comments about bubbles and crowd psychology. Bubbles are a strange phenomenon that is the culmination of "group think". More detailed psychology behind bubbles can be read at the good doctor's blog **http://tinyurl.com/rodhx**. To borrow a few lines from the good doctors, my favorite behavioral drivers for such a phenomenon are:

@Vividness of concept- China is going to need massive amounts of copper to industrialize an economy with 1.5 billion people.

@Perception of scarcity-We are running out of oil. Uh, that's a joke. We need to start using coal because oil is disappearing.

@Magnitude of payoff-You can make more money reselling a house in Miami or San Diego than you can make working a whole year.

@Urgency-You've got to get in now before it's too late.

@Impulsive behavior-The icing on the cake that transcends generations as a human trait with no end.

This cycle, it's so bad that even some of the most brilliant minds on Wall Street have bought into the concepts driving these assets. Although many are now running scared after the belief in housing and metals is been threatened. Jim Jubak over at MSN MoneyCentral has actually written that iron ore and copper are now scarce commodities in this global boom. Uh, I guess he never studied geology. Temporary supply constraints due to lack of exploration? Well, yes I can surely agree to that. Scarce? I've got some swamp land for you. One gentleman, and a very bright man, told me that the supply of copper on the London Metals Exchange was only 2 days when copper was over $4 a pound! Look out silver, we have a new precious metal! Wow, I thought. That is quite a small supply. Until I told him the average was ten days supply when copper was languishing at 50 cents a pound. He obviously thought it would be something like six months or a year's supply. I've even heard many brilliant Wall Street advisors argue these commodities are going to run for a "super cycle" of 10-20 years. Psst. I have a secret for you. Quit believing everything you read or hear. It has never, ever happened and I can give you a sound economically based argument that it can never happen. Now, will hot money float from commodity asset class to asset class over a period of 10-20 years? Maybe from metals to grains to food or whatever? Sure, that will likely happen. That's alot different than the Wall Street group think that copper, as an example, is going to trend up in value for 20 years. There is ZERO historical precedence of that. Just a minor hint for those who believe such a statement. IT WOULDN'T BE CALLED A COMMODITY IF SUSTAINABLE PRICE INCREASES OVER DECADES WERE THE NORM.

Let's look at the brilliant Gustave LeBon's work taken from "The Crowd" written over one hundred years ago.

http://tinyurl.com/ee786

“In it’s ordinary sense the word ‘crowd’ means a gathering of individuals. From the psychological point of view the expression ‘crowd’ assumes quite a different signification. The sentiments and ideas of all the persons in the gathering take one and the same direction, and their conscious personality vanishes. A collective mind is formed, doubtless transitory, but presenting very clearly defined characteristics. It forms a single being. The most striking peculiarity presented by a psychological crowd is the following: Whoever be the individuals that compose it, however like or unlike be their mode of life, their occupations, their character, or their intelligence, the fact that they have been transformed into a crowd puts them in possession of a sort of collective mind which makes them feel, think, and act in a manner quite different from that in which each individual of them would feel, think and act were he in a state of isolation. This very fact that crowds possess in common ordinary qualities explains why they can never accomplish acts demanding a high degree of intelligence. In crowds it is stupidity and not mother-wit that is accumulated.”

What did good old Forrest Gump say? Stupid is as stupid does.

Market Sentiment And Why A Trusted Indicator Will Likely Fail

That indicator is the survey results indicating the percentage of bulls and bears. There are quite a few of these surveys monitoring the sentiment of different groups of people. It could be amongst individual investors, professional money managers, etc. They worked quite effectively in the 1990s up through today. I would argue they worked through the 2000-2003 slaughter because people had never seen anything like an 80% drop in a stock market index like we saw in the Nasdaq. So, you had a generational bullishness that was not going to be broken by a correction after nearly twenty years of unabated rising stock prices. They were conditioned to use sell offs as a buying opportunity. So, you had alot of individual investors and very optimistic professional money managers holding through declines and actually adding to their positions. SAs stocks declined, greed instinctively took over and a tremendous amount of money bought stocks that were cratering on the anticipation they would rebound. It was a goldilocks economy or so we were told. Hence, the opninon stocks would surely come back up. That is likely why the chart I posted under Irrational Exuberance shows rising tick data in a collapsing marketing post 2000. ie, "Dip" buyers. Not to be confused with "Dipsh*t" buyers who they actually turned out to be.

http://tinyurl.com/po7z7

This also explains why sentiment readings worked so well in this period. Professional money managers and individual investors had never seen anything other than the late 1980s and 1990s and were conditioned just like Pavlov's dog, to buy the dips. For those who aren't familiar with Pavolv, he was a Russian scientist who proved dogs and even humans can be trained to respond in a certain way to a particular stimulus. Hence investors were trained to buy the dips and were rewarded just like Pavlov's dog was rewarded. Trained to respond to negative sentiment readings as a buying opportunity.

Today, that same scenario exists. The Wall Street traders and professionals are drooling, just as Pavlov's dog did, at the "great" buying opportunity presented here because the market dropped 5-10% and sentiment is very negative. Will they we rewarded with a bone? They might. I still have no positive clarity yet with my work.

Back to the sentiment indicator. The question is, why do I think they have a good chance this trusted indicator will likely fail at some point? (I cannot predict when it will happen just a rational historical perspective on why it likely will.) Well, one obvious answer is that it failed near the very top of the Nasdaq bubble in 2000. Sentiment was very negative at the end of 2000. Yet, we had really not even started any type of serious correction yet. Thus, at market tops and end of bull markets it appears very unreliable. And, I will argue in a post I will get up on Monday that we are not just at a top, we are at another bubble top. But, here's the main reason why from a historical perspective.

This market is very similar to 1973. Prior to 1973 we had a blow off stock bubble similar to the 1990s. It culminated with the most overvalued stock market since the stock market crash of 1929. The broad market declined from 1968-1970 about the same amount as we saw in 2000-2003 then the market started a rally in 1970 that correlates quite nicely to 2003. That rally and business cycle was very similar to today. A few highlights were:

@Profits were fueled by global growth

@High commodity prices and high oil prices

@Low interest rates

@A housing boom

@A weak dollar

@General malaise and fears of Japan taking over our economic mantle

@The S&P 500 PE was almost the same as today

@Very cyclical earnings similar to today where earnings are the most cyclical in 50 years.

That market eventually saw the S&P 500 fall another 50% in 1974. I expect mid 2006 to 2007 as the correlation to 1974. Picking exact tops is very difficult but my work showed we were likely topping in April or May of this year. Will that ultimately prove correct? We'll just have to wait and see because predicting exact data points is difficult. It is akin to palm reading. But, the bigger picture is less difficult to foretell and that is a very dangerous next twelve to eighteen months in my estimation.

So, given we are in the exact same phase in the business cycle and the stock market cycle, emotions would likely be very similar to 1973-74. Sentiment surveys, if available, would likely be very similar to today. A very skittish investor who had just experienced the stock market being slaughtered three years prior. When the market started to drop into 1973, did likely lousy sentiment fuel rallies? Did oversold conditions cause great bounces lasting months? Not really. So, will the fact that we have more "traders" today make sustained rallies more of a possibility or will the sentiment indicators that served bulls so well in the 1990s and the transition to a bear market in 2000 still work? Only time will tell but I would be very cautious if we have entered a new bearish market environment. My point is sentiment became very bullish for years on end in the 1990s. There is no reason the opposite could not happen for a period of a year or two if we start to see the market drop today. Below is a chart of the S&P 500 in the selloff of 1973-74. 18 months of selling and very sour sentiment didn't save the market then.

Again, chart courtesy of the brilliant team at Prophet.net

Thursday, June 22, 2006

What Are Long Term Interest Rates Telling Us?

Chart courtesy of Prophet.net

Many people have a firm understanding of how interest rates are set but let's briefly explain it for those who might be a little hazy on the topic. It's not like we all sit around studying economics or financial markets. In a nutshell, long term rates are set by buying and selling in financial markets just like stocks. Short term rates are set by The Federal Reserve. So, one could argue that long term rates are determined by natural forces while short term rates are manipulated to achieve an outcome. Hopefully a positive one.

The Federal Reserve has two mandates. Those are full employment and price stability. With the "Fed" raising short term rates to over 5% to combat perceived inflationary problems, the ten year bond and ten year interest rates are still hovering at the same price it was five years ago. The chart above is that of the ten year bond. The y-axis is the interest rate slid on decimal to the right. ie, 52 on the chart is a 5.2% interest rate. Financial markets tend to discount today's information and price information into what is happening six to twelve months from now. So, while the Fed jams short term interest rates to 5.25%, long term rates aren't rising significantly. Thus, the market isn't voting with the Fed that the problem is inflation or long term rates would likely be substantially higher. What are ten year rates telling us about six to twelve months from now? Well, unless they start headed higher and significantly higher, they are telling us the future expectation is that there is no inflation demon. That leaves a few possible scenarios to ponder. 1) Global growth will continue without inflation being a problem. 2) We are headed towards a slow down and that slow down may be deflationary versus inflationary.

Why do I throw in the deflationary comment? Well, for many reasons. I'll give you four to keep my typing down. Gold, hard asset prices, low long term interest rates and China. Gold has been on a tear this cycle. Gold usually rises rapidly under one of two scenarios. Those are either inflationary pressures or deflationary pressures. It is a hedge for either outcome. We all know that short term (this business cycle) there has been hard asset inflation. That has manifested itself in the form of housing prices exploding, industrial metal prices exploding and energy prices exploding. In fact, many of these have seen price appreciation unequaled in the last one hundred years.

So, we have hard assets at very elevated levels if not bubble levels, we have a likely bubble in their corresponding stock prices, we have gold rocking upward and we are likely near the peak of the economic cycle. So, if we have a slow down which is nearly inevitable, what will happen to all of these hard asset prices? They will drop and if history is a guide, they could implode. So, where's the long term inflation in this scenario? There isn't any. Short term inflation driven by a massive global liquidity glut and long term deflationary pressures once that liquidity glut is taken away. Basically, we didn't beat the deflationary devil that central bankers feared post 2000, we likely just shuffled the deck before dealing the final hand.

Synchronized global growth and excess liquidity do not mix. They jointly create a tremendous strain on the system. The last time we had three years of such high sustained global growth was the early 1970s. We also had an asset price explosion which followed a stock market bubble just like today. The potential difference is inflation did take hold and it stuck in the 1970s. Why? Because wage inflation took effect. You see, consumer inflation cannot take hold unless the consumer's wages are going up to pay for inflated goods. Today they aren't. At least, not yet. And, I'm suspect that they will not unless we can keep this party going for quite a bit longer. If we do and it does (figure that one out!), the party will just get uglier. Because then we'll really get a jump in Fed rates and that will surely kill consumer spending and global growth. But, hold on! Why won't that likely happen? Because China is melting down right now and they have massive deflationary pressures building to a crescendo in their economy.

So, what happens as China begins to crater? They flood the world market with cheap goods to try to keep the dream going cause there isn't anyone in China buying anything. ie, Exports are the only way for them to shovel all of that shit onto someone because they have not reformed their economy to drive consumer demand. This could possibly be the fuel to ignite the cycle of deflationary pressures. Sounds like.............1929. While no one can predict the future and that is a doom and gloom outcome, there just might be some truth to its possibility. It doesn't need to end up with another Great Depression but then again, no one knows. More on that one in another post.

What's the moral of the story? No free lunches. Never has been and never will be. The world has been on a growth and spending binge for more than a decade. When these types of excesses build, historically the only way out of this mess is a cleansing of the system. Japan found that out with 17 years of deflation and 17 years of falling stock prices. It's pay me now or pay me later because there ain't no such thing as a free lunch.

Follow Up On Google. Let's Look At The Stock!

Chart courtesy of Prophet.net

Since I wrote about Google's business model and had a few extra minutes, I thought I would pop up a chart of Google. While I can't give investment advice on here nor will I share my secret sauce, it is interesting to note Google's chart. Charts are an integral part of trading because they almost become a self fulfilling prophecy. Hedge funds use them, professional traders use them and program trading uses them. If you trade, you must know how to do some basic charting.

This chart is of the entire stock history of Google. It is a weekly plot of prices. Notice how the price bounded around in a clearly defined channel on its rise. At the beginning of 2006 greed jammed the price up beyond the channel in a rapid rise of about 55%. This was near the time of the $2,000 stock price mania. This move failed and the stock collapsed to the bottom channel and started rising again. Google has now made a lower high in April of 2006 on the chart and failed to exceed its prior high. This is the first time such a phenomenon has happened and that is significant. Now, the decreasing trendline connecting the two prior highs acts as resistance to the stock rising. In addition, Google is forming what is known as a wedge pattern where you have a narrowing of the stock price into a conical pattern or an arrow pointing to the right.

This is usually a sign of pent up energy as the stock is becoming less and less volatile. So, which wedge trend line will be broken in a likely explosive move? Is the stock destined for new highs or a drop below its upward trendline? Google's earnings announcement will likely hold the key. To buy now and hold through earnings is not investing. It is gambling. We are likely very near a critical juncture for Google's stock.

What Is Google's Strategy To Remain Relevant?

http://blog.searchenginewatch.com/blog/060109-123535

It might but more than likely the answer is something more akin to what the hell are you talking about Jack? That's a market cap of $600 billion dollars and this is a $5 or $6 billion company today with ONE crude product. A product that I believe could have a limited life as our web experience transforms. So, $2,000 a share is about the same market cap as GE and Exxon combined. Yet these two companies have combined revenues of $500 billion and a combined gross profit of $240 billion dollars. Plus, these companies have tangible assets to the tune of $250 billion in book value. That includes massive reserves of black gold, patents galore for both companies, refining capacity, manufacturing capacity, research labs, etc. Google on the other hand has a gross profit of $3.5 billion and a book value of $10 billion.

You gotta be smokin some mean crack to even THINK about putting such as assinine price target on any stock. It is irresponsible and it is Wall Street at its finest in my opinion.

So, what is Google? A glorified search engine. I'm sure one with great technology but still a search engine. And how do they get revenue? By you clicking on ads interspersed with search results. And, we are talking a market capitalization of $600 billion? I don't care if it ten years from now. We have no idea what the net will be like ten years from now and Wall Street definitely has no idea. You want to know how fast Google could become nothing? Look how quickly Google ate Yahoo's lunch. They were a dream in someone's eye just a few years ago. Technology is a brutal business and with 6 billion people on the face of this earth and a few thousand working for Google, the chances are the next big thing on the net aren't coming from the 8x10 to the -5th of one percent of the world's population working for Google.

So, enough cynicism. Let's look at the net and how it could likely unfold. I don't have any insight that others don't but let's take a stab. I see many parallels to the net and the evolution of corporate computing over the past forty years. And, as odd as it sounded when Sun Microsystems coined the term, "The net is the computer" it was indeed a truism.

So, in the beginning God created computers. They were used to store reams of information and process it in manner that was significantly faster than the mountain of people who did it by hand. Then, we developed the ability to organize the data and slice it many ways in an ad hoc fashion. That was about thirty years ago. That's where the net is now. Google is that vehicle. Crude ability to manipulate data. But when I do a search, I can get back ten million results and five may be relevant to what I'm looking for. Is that great or what? As an advertiser, how confident are you that the people clicking on your ads are interested in your product? What's the ROI for ever increasing costs of advertising with Google? That might not matter when companies are spitting out record profits but it will matter soon enough. Yes, Google is the leader in search. They do one thing better than anyone else. But they still are very bad at it. So, what happened next in corporate computing? Applications. Integration of many applications. Access to real time data on business results with the click of a button. Access to customer data in real time. Collaboration. Access to supplier information in real time. Sharing of ideas. Micro-granular data down to the penny of what you are looking for in real time. The net is one massive intelligence in its infancy. Over time, it will evolve. Into what? Well, that cannot be answered by the limits of any individual's mind. Long term the net will transform human existence both at work and at play. Today we have eBay tomorrow we have The Matrix.

So, as the net develops, we will all become tied to the "system" in some form of "awareness" or "oneness" where we are always "online". It likely isn't going to be staring at a 19" LCD monitor that I am using to type this. The majority of the world's population will experience the net via some type of handheld or mobile device as it grows. Maybe next is an earpiece with voice command. Maybe next is a pair of glasses with a type of "heads up" display built in. Maybe we won't even be using a display of any type. Maybe it will be voice driven access to applications, content, personal information, Q&A, search, entertainment, etc. You see Spock baby on Star Trek hammering on a keyboard staring at a Google search result and clicking on an ad for beer? And, a new paradigm will likely develop very rapidly from where we are today. We are currently doubling computing power every six months. If that does not accelerate, and I believe it will, that means we will have 1 million times the computing power we have today within ten years. (2 to the 20th power) Your PDA is one million times faster? Your earpiece is one million times more capable? The computers behind the net are one million times faster. With software capabilities that will likely boggle the mind. You gonna be hackin on a PC and clicking on Google results? For that matter, what's the chance you are going to be carrying around a single use MP3 iPod from Apple? You gonna be using the net for rudimentary search? Are you kidding me? So, if Google's revenue stream is via paid search and it requires you to be sitting in front of a PC and to click on the ad, is that in our future? It might be in yours but it isn't in mine.

Or will you be talking into your earpiece and asking the net to pull up your favorite tunes? Or chatting with your friend with a holographic visual of their face right in front of you just like on Star Wars? Or watch a movie with your heads-up display glasses or holographic generator on the train ride home? Or have the news you care about read to you by the net? Or you telling your coffee maker to turn on, add a dash of sugar and two tablesspoons of cream before you come home? Or talking your college exam into a virtual voice processor then shipping it off via a voice command to your professor? Or hopping into the Matrix for some pleasurable passtime? Or who knows what? The point is the net will be part of your very existence and it will be an extension of your daily life to be used as a productivity and entertainment tool running applications that have not been dreamed up.

So, tell me how does Google get to $2,000 selling you paid search in that environment? In the future would they plan to have voice ads? Commercials on the net fed to your earpiece? Not! And, why would the application providers of the future want to pay Google some type of fee? Maybe that fee is as an aggregator of data. Maybe they provide the "feed". But that is not their business model today. They'd better hope web access is free in the future because if I'm using an earpiece on a Cingular network, you can bet they want to control any ad revenue if there are any ads at all. Uh, I hope Google has alot of people strategizing on what their future is and maybe a few less people working on a kludgy spreadsheet in some half assed attempt to meddle with Microsoft. Listen guys, Microsoft Excel or the grip Microsoft has on PC's is not your biggest threat. How does this future translate into revenue for Google? They need to constantly innovate and find meaningful new ways of generating revenue while their current model allows them to print money.

I think I've convinced myself. I'm going to go buy Google tomorrow and ride it to $2,000! Can anyone tell me what the qualifications are of being a Wall Street analyst? JEEZ, it's a bloody search engine not the cure for cancer.

Wednesday, June 21, 2006

Irrational Exuberance

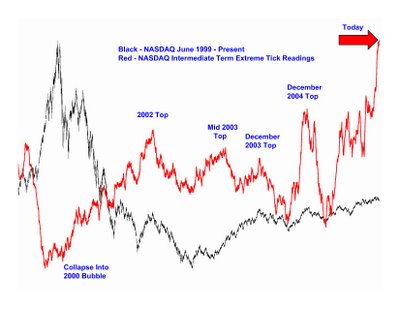

Here is a chart of market internal strength as measured by buying and selling pressure. Tick readings actually. What is a "tick"? A "tick" is the minimum upward or downward movement of a stock. Stocks closing on their up tick are usually under accumulation. Vice versa for a down tick. Extreme readings in either direction are good sentiment indicators of bearishness or bullishness. ie, The higher the red line, the more crazy people are acting in the stock market. That almost always foretells a very risky situation. It can yield additional insight into exuberance or lack thereof than simply looking at esoteric data. ie, Regardless of what the sentiment surveys are saying, there appears to be alot of optimistic people taking a tremendous amount of risk right now. More so than anytime this cycle. Frankly, more so than anytime in six years or more. That contrasts with 2003 when we had a subdued, more orderly flow of investment dollars pushing the market higher.

Now, I hate to say I told you so but I sent this chart to a few friends back on April 20th then updated again on May 5th. This is the chart updated from May 5th. On May 5th, the bulls were crowing about how great the economy was and how the stock markets around the globe were doing so well. Just a few days later we saw international stock markets tank by 20-35% and many of the market leaders in the US had similar crushing losses. So, is the fun over?

Is This A Healthy Bull Market?

Whether it be IBM, Dell, Microsoft, EMC, GE, Intel or a host of other large capitalization technology stocks, they are dying a slow death in the stock market. These empires of American industrial prowess are still recovering from their massive bubble run ups into 2000. In fact, the majority of large cap technology companies had a bull run of exactly nine months this cycle. That was when they bounced from bear market lows in early 2003 and generally peaked at the end of 2003. Since then, they have done next to nothing or even collapsed to near 2003 lows. A nine month bull market? What say you? Indeed. So, while the pundits banter about the strength of the U.S. economy, there is something missing. That something is participation by the economic giants of our country. To top it off, they are extremely risky investments regardless of their PE because they pay a paltry dividend for those who wish to buy. There is little visibility into valuation using discounted cash flow analysis if you aren't banking on a 3, 4 or 5% dividend in the calculation.

On the other hand are charts of two leaders in this bull market. Valero Energy and Phelps Dodge. One is an energy company and the other a mining company with an emphasis on copper. So, the major outperforming asset class this cycle has been weak dollar-inflationary commodities, oil and related sectors. These market leaders, when rising, diminish wealth. Are you wealthier when you have to buy a house for 5% more because copper wiring prices are through the roof? Are you wealthier when your heating or cooling bill is double last year's? The answer is clearly no. This type of cycle is usually abbreviated because input costs, ie, commodities and sometimes labor are rising at an unsustainable pace. Thus, the normal flow of cyclical earnings is choked off and we tend to have deeper and longer recessions historically. I am very confident, regardless of what is reported in the press, this is not a healthy stock market nor is it a healthy economic expansion.

Now, that said, it has been a rewarding stock market for those invested in the right sectors but they are not indicative of a healthy economic climate. So, should stocks go higher here, we will likely be led by the same inflationary sectors. I look at that as a time to lighten up on what I consider is a very risky stock market. Somehow, I don't believe this cycle is going to end kindly either on the economic front or for those who believe in "buy and hold" investing.

Tuesday, June 20, 2006

The Truth About Global Warming And The Economic Opportunity It Presents

So, back on track. I look up the web site for this competitive something or another. The guy and his entire team are attorneys, MBAs, real estate experts, taxation experts, etc. I've met my fair share of MBAs. Nary a one was well versed in science unless it was one of the few scientists who happened to get an MBA. So, when do MBAs and attorneys all of a sudden become experts on science? Especially since, on average, none of them have ever cracked a serious science course or have any formal training or work in research? The reality is this guy was likely a lobbyist for companies who do not want to pay to clean up their polluting ways. You know, the same people who were dumping mercury into the water supply by the ton when they knew it would kill people because properly containing it would cost their company money. Oh, yea, those people. So, do you believe a likely lobbyist or a researcher from MIT? How smarmy can people be? I mean really? Do you care about your children? Or your grandchildren?

No one really knows how much human kind is affecting the planet. Most scientists will admit this. They will almost universally admit the planet is warming because it is proven scientifically beyond a reasonable doubt but don't know that we can actually pinpoint how much is man's making. We go through temperatture cycles on this earth and have well before man got here. But, why risk it? Because you want to make more money? Because you don't want to spend more on research because it would have otherwise been booked as profit that might have gone into a CEO's pocket?

Energy efficiency and environmental friendliness could and likely will be the next great growth opportunity for technology in America. Or, if we don't jump on it, someone else will. Japan, China, Germany, England, Russia, France? So, given that fact, do you, an American, want to leave our economic future to chance or do you want to lead in the race to dominate environmental technologies? It could be a source of great job creation in highly skilled fields of innovation. Research scientists, engineering, marketing, sales, accounting, manufacturing, etc. We need an energy policy in the United States and more importantly, we need a strategy the country is gunning for. The President can provide that beacon and leadership just as he did with the Apollo program to send man to the moon. Our strategy should incent the markets to take risk and rewards them regardless of whether oil is at $15 or $85 a barrel. We don't need government subsidies. We need government coordination and incentives via tax breaks and regulation reform. Write your Congressman(woman) and demand their action!

Monday, June 19, 2006

The Problem With Listening To The Financial Press

As someone who trades alot, I am highly suspect of alot of "indicators" touted in the press. Today in the New York Times, Mark Hulbert has an article about such secret sauce.

While I tend to agree that the future of equities is bleak and we are almost certainly going to experience a very dramatic global economic slow down, let me remind people that we had a 400% rally in the Great Depression so economics and equity markets are not what I would call statistically correlated. And, while I use economic data as anecdotal information to develop my risk management strategy, in no way do I use economic data to determine if I am in or out of the equity markets. To do so has proven historically foolish. And by historically, I mean over the last one hundred years of equity performance.

This chart looks mighty fine in retrospect....sometimes. So, it appears from approximately mid 1995 to 2000 when the Nasdaq was up 800%, this model would have you in cash. Yet, in 2000, when equities peaked, it would have you buying stocks just in time for an 80% correction in the Nasdaq. And, guess what? Indeed Mark Hulbert had a similar article talking about the same model in November of 2000. Here's the link.

http://tinyurl.com/pvjsq

or

http://www.nytimes.com/2000/11/05/business/

05STRA.html?ex=1150862400&en=a243a3a469d29088&ei=5070

There are two problems with this as I see. First and foremost, never invest in a newsletter or service or advisory that is not trading right along with you. Be it a short term trader or a long term investor. If they aren't trading or investing, their advise is worth very little in my opinion. They aren't going to feel the trepidation or pain you feel if they are wrong or experience the losses. It's awfully easy to talk about buying and selling but when it comes to believing in your model because back testing and soundness of capability has made it a high probability time to be in the market, well, that is totally different all together.

Sunday, June 18, 2006

Is Microsoft At A Turning Point?

Something extremely significant happened a few days ago. After years of plodding along as a brute rather than an innovator under the leadership of Gates and Ballmer, a new face emerged. The face of Ray Ozzie. Amongst all software eggheads, Ray is somewhat of a god. He has transformed himself, the companies he has worked for, the technology industry and business with his products many times with his laser like vision for creative change. Ray may be the most impactful figure in software on earth today. And before joining Darth Vader at Microsoft, he had fought the good fight successfully time and again causing Microsoft fits.

But now, Ray is responsible for the technology roadmap of one of the most powerful companies on earth inheriting the mantle from the evil doer himself, Bill Gates. You see, technologists have understood since the beginning, Bill was a master marketeer but not a technical genius. What does it possibly mean to have a creative genius at the helm of the world's richest company?

I have no doubt Ray's entrance into Microsoft was with a promise this day would come. Ray's latest company was acquired by Microsoft a few years ago. And it was a marriage made in heaven with smiles all the way around. But why would Ray join what he has shunned his whole career? Ray has never been a big bureaucracy boy and when IBM acquired his greatest invention of the time, Lotus Notes, Ray couldn't be bought along with the software. Frankly, that is one reason why IBM has screwed up Lotus notes and never been ahead of the curve with their software architecture. So, why'd he stay with Microsoft? For this day which was undoubtedly promised to him. Hey, would you turn down the chance to be the chief software architect for, arguably, the most powerful IT company on earth?

Now, there has been little press with this announcement. There was quite a bit of fanfare that Gates was giving up the role of Chief Software Architect but that was more along the lines of what will Microsoft do without him? And if Ballmer is shown the door or another new junior face emerges in a role to be groomed to replace Ballmer, Microsoft is going to be back in the game big time. You see, we are likely on the verge of great change as it pertains to the internet. The experience today is extremely crude. It is where corporate IT was thirty years ago as far as maturity. So, who has the resources and breadth of capabilities to be a(the) leader in transforming the internet into a rich content experience? Microsoft.

Most people think of Microsoft as a desktop operating system or spreadsheet company. Well they are. But Microsoft has so much intellectual capital that is available via products and services that it boggles the mind. There are literally over a thousand products from security to wireless to server software to gaming to systems management to education to server middleware to server database software to applications to productivity tools to operating systems to consulting services to web tools to application development to paid search to portals to digital rights management to handhelds to entertainment and on and on and on. They are far from "tied" to the desktop although it is a cash cow of enormous proportions. To the contrary, Microsoft is also the global leader in server licenses. Guess what is behind all of those web pages? Servers. Just an example of many fallacies about Microsoft.

So, to now have a genius and visionary like Ray Ozzie setting Microsoft's software strategy is a day many companies will fear. Will Microsoft become the visionary and innovator in the new growth areas on the net and within software? I don't know but the world just got alot more interesting.

Microsoft suffers from big company disease. They have become like IBM, GM or Ford. Companies which start out being quick, nimble and creative turn into slow moving monoliths which use their weight and influence to drive their business rather than what made them successful. Every once in a while a leader comes around which can unlock the talent contained within a company as rich as Microsoft and make the elephant dance at break neck speed. In today's global business, the undisputed leader with this talent is Carlos Ghosn at Nissan and now Nissan and Renault. Ray Ozzie does not have the skills necessary to be that person at Microsoft on the business side but he does on the innovation and product side. Will his persona and creative leadership unlock the juices at Microsoft's labs? So, the key question in my mind is if Ozzie's leadership of the geek squad is going to be married with just as dynamic a face on the business side. If so, beware of the sleeping giant.

Friday, June 16, 2006

The Goldilocks Economy Never Existed

We can't get any follow through in stocks. We are at levels of oversold which should eventually drive a rally of some sorts. But, unless the bulls get it in gear soon, we are going lower.

So, anyone take a look at the program trading volume on the NYSE? 73%? Uh, is that like some kind of record? Ok, so there may be some double counts in there. When was the last time we saw this? Can you say 1987? And the macroeconomic circumstances could be loosely interpreted as similar as well. Forget about what "kind" of growing economy we had, more along the lines of international trade, the dollar, gold, real estate bubbles overseas, etc.

This is NOT a healthy correction that we see in bull markets as we are led to believe by many. But bear markets always start with the bulls calling this an expected correction. The reality is this is a rout in developing markets and a market where growth in tech equity prices peaked two years ago.

Who's pushing the trigger on that rout? Seems to me we had this kind of scenario once before where a handful of financial institutions controlled most of the trading on Wall Street but now it's globally. When was that? Oh, yea. 1929. Didn't Congress fix that situation? Why they sure did. It was called Glass-Steagall. And, what happened to that reform? In the hey day of Pax Americana and goldilocks the greedy bastards on Wall Street lined your politicians pockets and they blew it up. Obviously for the betterment of Ma and Pa America.

http://www.pbs.org/wgbh/pages/frontline/

shows/wallstreet/weill/demise.html

So, does the concept of reversion to the mean apply to more than just equity markets? We are told by many that it is a natural progression that we move away from heavy industries into finance and services. A service based economy. ie, We are too sophisticated to be bothered with menial labor. We outsource that to the developing world. Maybe. Finance is a higher percentage of

So, is housing a bubble? Maybe not. But, for forty years housing tracked about one to one with new household creation. Now, it's about two and one half to one. And mortgages? Well, the mortgages as a percentage of total banking loan revenue has doubled in the last few years to anything well beyond its modern historical averages. So, now those same financial institutions that control your equity markets are also overexposed to risk in real estate. Can you say banking crisis? I don't think it will happen but risks are rising and we are creating a potential mess at some point with lax regulatory controls. And why do we have those lax controls? Greed. Only the kind available to American financial institutions that donated hundreds of millions to our very willing elected representatives that would get the laws overturned for favors. Monetary favors. In the end, will the entire process lead to self destruction? ie, Will Wall Street’s drive for more and more power ultimately lead to its own self destruction and rebuilding? Like 1929 when the head of the NYSE was carted off to jail?

So, are we in the heavily regulated 1970s where inflation was the problem or are we in the wild and wooly 1920s where regulation was yet to be adopted to keep Wall Street from hosing us all? Don't just think in terms of