The Cycle Of Volatility And The Deluded Human Mind - Part Deux

Back at the end of March we put up the original post of this name. It was an open ended post without any context or further information. I wrote at the time I would put up a follow on post explaining its context in a week or two. Well, that week or two has passed and this is the follow on post.

Cycles are part of our every day life. We see cycles throughout the natural world and the universe. The cycle of our heart, the gestation cycle of life, the daily cycle and the seasonal cycle are but a few of countless examples of cycles. There cycles that last seconds and there are cycles that last thousands of years. There are cycles that we clearly don’t recognize nor do we understand. And there are cycles well too long for anyone alive to even recognize as cycles.

One of the major themes on here is that we are in a cycle of volatility. And, as such, the linearity of the last few hundred years is no longer applicable. In other words, as it relates to finance and current economic ideology, the world as we know it is over. These are failed ideologies never to rise again. Everything society thought they believed is coming into question. Everything society thought they believed is being exposed as a massive delusion.

So, what were the two charts I put up in the first post at the end of March on The Cycle of Volatility and the Deluded Human Mind? The first chart is the 21 year view of the Dow leading into 1929. The second is the 21 year chart of the Commodities Index leading into 2008. Both charts are essentially mirror images of one another. A long period of range bound movement followed by an explosive and criminal financial bubble, one in equities and the other in commodities. And both charts span an entire generation; a cycle in itself. enough time to delude an entire society and an entire world as to a new economic and financial paradigm (house of cards) while prior generations, who learned from prior economic stupidity, fade into obscurity.

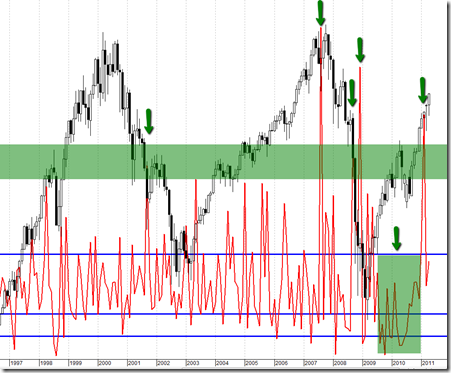

Below is an updated commodities chart of the one posted back in the final days of March. Our initial post on The Cycle of Volatility and the Deluded Human Mind was posted coincident with that last green candlestick on the chart below. Or the last “up” month for price. Almost immediately after our initial post, commodities markets started crashing. Many commodities were limit down many days as the Ponzi scheme started to unravel. And oil had its largest single day drop. Ever. Now, Goldman Sachs, Morgan Stanley and other perpetuators of this massive attempt at rigging markets are bullish on commodities once again. We shall see. A very bearish monthly formation has taken hold before commodities were able to regain their old highs. And, just at the world’s volatility is picking up again – volcanic and seismic activity over the past few months, debt crises again, economic uncertainty in the reported data, job creation lagging once and Wall Street is the most bullish on commodities and financial markets since the collapse in 2008. And the perpetuators of this con, Wall Street firm’s stock prices haven’t made a new high in a year. Will this end with the same incompetent stupidity of all of their other Ponzi schemes. Including the parallel fraud used in this post, the 1929 collapse – a similar environment to today but instead of equities, it is now commodities – the new investment class that pays nothing and earns even less.

To the extent that Wall Street gets away from book value, it is headed into potentially dangerous areas of thinking. It then introduces factors – chiefly the notion of increasing future earnings – which are very difficult to measure and which therefore may be badly measured. -- Benjamin Graham, most likely the greatest investor of all time

Quantitative finance and commodities investing are all based on factors. All of it. And all based on future earnings and thus earnings-driven demand for commodities. And none of these factors will ever shield financial idiots from the volatility of the real world. These schemes are nothing more than creations of the ego. And as we have said before, in the cycle of volatility, the institutions of ego are subject to failure and collapse. Tens of billions of dollars wasted. Trillions of dollars of economic opportunity lost on employing people in ridiculous schemes.

Inflation is too much money chasing too few goods and services. That is not what is happening in the world today. What we have is too much speculation in financial commodity markets enabled by derivatives, leverage and a banking system able to print money out of thin air to commodity prices through the roof.

The many remarks of people who state that we are going to experience asset deflation while commodity inflation are ridiculous. They don’t understand what is going on in the commodity markets. Commodities are all going to bust. It’s just a matter of when the fraud and corruption collapses as it always does.

This is nothing new. We have written extensively about this scam over the past six years while every financial commenteur, bull or bear, in the U.S. has been deluded by the brainwashing of a corrupt financial system and its latest scam, commodities investing. Let’s look at an example we wrote about before the first commodities collapse. It takes 5 cents to mine a pound of copper. Regardless of the inflation rate or value of the dollar, the price of copper has never exceeded 50-60 cents in the last one hundred years. It has recently been at near $5 a pound. That mark up of 10,000% between cost and price is because of one dynamic and one dynamic alone; Wall Street has spent billions of dollars creating an Enron-type trading environment for energy and commodities. And when our government’s bailout of the criminal class took place back in 2008, it simply allowed them to reignited the same failed and criminal commodity speculation. This should be as no surprise since Wall Street was behind the original Enron and most people don’t realize these same financial firms were penalized billions of dollars for their involvement in Enron. What should have happened is they should have been criminally-investigated just as Enron was. Instead we have simply allowed the monster to become so large that it now murders people around the world who are unable to pay skyrocketing costs for commodities including food. This whole dynamic is only possible because commodities are valued in dollars and because the dollar is the world’s reserve currency, thus allowing Wall Street to manipulate prices and extort a massive tax on any consumer or user of commodities around the globe.

It is simply supply chain intervention. The insertion of a tax by financial mobsters. It’s the same type of thuggery tax that the mafia extorts from businesses who operate in their neighborhood. And as I highlighted before, RICO racketeering laws used to prosecute the mafia and organized crime should be used to prosecute Wall Street.

Some commodities markets are small enough to corner with minimal amounts of money, especially due to the explosion of commodity derivatives, created by Wall Street, that allow heretofore unavailable leverage. Be that gold, silver, corn, wheat, lead, oil, rice or whatnot. Once it creates the infrastructure of financial trading and leverage needed to mint massive profits at the expense of others, Wall Street needs to convince society on all of these “investments” to make their Ponzi schemes a reality. And entire industries have been built upon these massive Ponzi schemes. And now your pensions are invested in this scam because advisors from Wall Street needs to create a herd mentality to mint its massive taxes.

I even know farmers participating in commodities Ponzi schemes. Grain trading firms encourage farmers to hold their crops in an investment pool thus artificially limiting supply as these firms in concert with hedge funds and Wall Street, are then able to use this scam to ramp prices artificially higher for massive profit. People can’t feed their family? Who cares? Not the Wall Street sociopath. This dynamic is exactly what we wrote six years ago about what happened in the roaring 20s with stock pools. Instead now it’s commodity pools, insider trading and packs of hedge funds that accomplish the same dynamic using leveraged financial derivatives in bubble stocks, commodities, etc.

This type of extortion and predatory finance is no different than the state-sponsored extortion of genetically-modified foods around the world or the extortion of society to bail out Wall Street criminals or the extortion of other corrupt states to do the will of the American war machine or the extortion of a fraudulent health care system. It’s all driven by selling out our government to rig the game in favor of massive corporations who are able to price their payoffs of government beyond the financial reach of any other voice in Washington. The housing bubble is small potatoes. The corruption in our political, banking and corporate system is massive and transcends all facets of our lives and our society. All of this and substantially more is enabled by a completely corrupt financial system and a captured, fascist government.

Because of this criminal behavior, a private banking system is able to determine what society values as economic opportunity. And, frankly, much of our leadership’s social and moral values. As Wall Street creates its endless Ponzi schemes, whole new industries spring up to support its massive fraud. And legitimate enterprises make plans and investments determined by anticipated outcomes that never materialize. Let me give you a few examples.

First, the dot.com boom in the late 1990s. Millions of unsustainable primary, secondary and tertiary jobs were created surrounding this phenomenon. People and companies started ventures totaling billions of dollars. And anyone with a wild-haired idea got funding and went public. Millions chose degrees in computer science or jumped into the field of finance or companies made massive investments that never paid off or governments started projects because of higher tax receipts. And then secondary and tertiary businesses popped up in supporting roles. Business plans were changed and debt taken on to expand to serve this new Ponzi scheme. The impact on the economy was endless. People, companies and communities changed the way they did business to take advantage of this dynamic. But it was all a fraud perpetuated by a private banking system run by criminals. What came out of this that was sustainable? Almost nothing. It all collapsed.

Then came the housing and real estate bubble. Millions of people jumped into the field of finance or started their own interior design business or became architects or started construction businesses or mortgage businesses or became home inspectors or overbuilt commercial real estate with the same dynamics. Business plans were made and debt was taken on to expand businesses to serve the Ponzi schemes. And software companies popped up to service them. Real estate sales positions exploded. The list is again too endless to document. And it was all a fraud created by a criminal private banking system. How much of that was sustainable? None of it.

Then we have quantitative finance. Millions of new jobs in finance and supporting roles. Thousands of hedge funds or thousands of scientists and engineers now working in finance or new quantitative software companies or the IT infrastructure boom to support them or the billions of dollars spent developing the trading algorithms used on Wall Street or the many trading advisory services and selling these schemes to pensions and retirement funds and on and on. It too is unsustainable. It too will fail.

Then there is the commodities scam. Maybe the most criminal of all scams because of its impact on people around the world. Massively distorting costs in basic necessity products that the world’s poor and underprivileged rely on to live. At the same time, encouraging farmers to overinvest in equipment and paying exorbitant costs for land that will eventually come crashing down when the scheme unravels. Encouraging pensions and investments for our society to invest in ridiculous notions that no one understands. Thus threatening our social stability (At the link, others are finally starting to understand the criminality of it all.) and leaving us holding the bag for their criminal negligence. Peak oil, manmade global warming, the Chinese miracle, a permanently high commodities plateau from Malthusians including Jeremy Grantham who recently wrote, ridiculously might I add, of such a dynamic. Just as Alan Greenspan wrote of a permanently high plateau for the American economy right before it imploded.

Students lined up to pay upwards of a quarter of a million dollars for an education. To learn theories based on bullshit. And to participate in a career that is nothing more than a delusion created by a financial bubble. So, how much of the world around you is actually delusion based on brainwashing…. or adaptation

All of these schemes are doomed to fail. None of them create capital. Instead, they simply shift capital. And as such, the limits on capital will eventually be reached. That means we are guaranteed crisis after crisis as this dynamic unfolds. And this shifting is from the world’s poorest people to the world’s richest. And because of shifting capital as opposed to creating it, we see that the concentration of wealth around the world is at incredibly distorted levels. The real crime is not debt slavery. It is economic slavery. Economic slavery creates debt slavery. Those who are accumulating the most capital are the most criminal and the most complicit; even if it is acting as a useful idiot. These are crimes against humanity of the most grave scale. They are crimes that rival those of the most oppressive and evil regimes ever to come to power.

These crimes are timelessly part of an economic system that is always being subverted by evil. We saw it one hundred years ago and we see it again today. We saw it in the S&L crisis under Reagan. The junk bond debacle under Reagan. The start of the lobbyist bubble in Reagan. We see it in the criminal credit default derivatives scam. We see it in a perpetual underclass of Americans denied access to capital and denied since this country was founded. The list of abuses are endless.

We need an economic rule of law to protect us from evil. We need an economic constitution. These are but examples. We could cite healthcare, investment banking, mergers & acquisitions, private equity and on and on and on. And the same holds true throughout all of history of private banking. It’s a never ending list of fraud that serves a very few and endlessly destroys the lives of everyone else. It perpetuates racism, class struggle and underprivileged. It perpetuates endless bribery of our government and corruption. It subverts democracy. And it keeps us from having an economic model that serves democracy.

Did all of those MBAs headed to Wall Street over the last decade make a brilliant educational decisions? Or are they simply unknowingly complicit in our own destruction? Deluded by personal desires of power by a system that perpetuates fraud. Destruction enabled by Harvard, Yale and other elite schools that pump out these worthless degrees embracing junk economics and voodoo finance. Has our economy adapted to become something new and vibrant as Treasury Secretary Paulson believes or have the assholes on Wall Street effectively forced society into jobs and careers that are completely unsustainable yet serve the greed of the most power-mad in society? Have you actually learned anything during your life time or are you simply adapting to a system of fraud and corruption to survive? And is it really any different than the brainwashing of society that the Nazis or the Chinese communists so effectively imprinted on society?

We live in an unsustainable world created by the endless supply of dickheads and morons like Alan Greenspan, Al Gore, Bill Clinton (The worst President in the history of the United States), Newt Gingrich, Hank Paulson and others who undemocratically believe they are uniquely qualified to tell us how our economy and our society should be run. And the jobs that we should desire and those which we should offshore? This is a world of tyranny where economic opportunity is determined by the most incompetent power-mad, emotionally-unstable elements in our society.

What is really real and what is a lie created by delusion , avarice and power? I’ll tell you what is real. All that comes from within. Your self-expression, your dreams, your love for your family and friends. The rest? It’s all an illusion. And it’s an unsustainable one at that. The status quo’s con game is over. And there is nothing they can do to save it. Now we wait for the real world to reveal itself. And with it, comes enlightenment as to what truly is real. You are real. I am real. The world that con men have created is nothing more than a bad nightmare.

Private banking monopolies with a primary motive of profit rather than serving society is a relic from the past. It has no effective use in the development of democracy. To seek to institute a gold standard and keep this model is putting lipstick on a pig and will return us to a time when corruption was just as rampant by the for-profit banking system’s denial of capital to underprivileged and to many of society’s most gifted who could give economic opportunity to and employ countless Americans if given access to our own capital. We need a public banking system that first serves democracy and all Americans. If we want a private financial system to compete with ancillary services, that is fine. But we live in a tyranny that is enabled by private banking. By denying Americans their basic economic rights through predation. Wall Street is nothing more than a criminal enterprise. It serves no purpose. None.

Most people, including most assuredly all politicians, don’t take the time to think about how private banking shoves people in the direction of personal motive rather than human developmental needs. Everything our society values economically and often socially and morally is determined by a false moral system created by for-profit banking. Anything that the individual wants is irrelevant. Private banking creates a false value system perpetuated by unstable crooks.

So, have you ever asked why? Or did you just accept what politicians and Wall Street was telling you? Did you ever question or did you just go along with the herd? So, how many other things in your life fit into the same dynamic? What have you really learned in your life? Seriously. And how much of it was simply adaptation? Or even delusion or illusion?

Some years ago, we coined this environment as the rise of the bureaucrat; the blood sucking CEOs, politicians and banking cabal who has chosen to enrich themselves off of the backs of others including underpaid Americans, slave labor in emerging markets and financial speculation – all at the expense of society and community. These are people who create no wealth but instead simply steal it.

Nature loves diversity. When that diversity is lost, populations are at a higher risk of collapse or crisis be that the food supply, animal populations, insects or even the whole ecosystem. The same holds true with our economic ecosystem. The fact that this economic catastrophe is dominated by bureaucrats who have effectively monopolized the decision making about our economic environment, stifles economic diversity and society’s ability to produce its own capital. So, we have to borrow it from outside of our borders. The Soviet Union of the United States. Contrary to many who believe our economy has become too complex, in actuality our economy may be much less complex than at any time since the start of the Industrial Revolution as a small number of bureaucrats rig the system for their benefit. We should expect the outcome to be no different than in any other instance of nature where diversity and natural complexity has been subverted. Eventually, the system will again see crisis. Elites have won nothing. Their desire for ever more is never enough for the empty soul. They have sealed their fate. Karma is a bitch.

A private, for profit banking system determines who gets access to capital in our society. It effectively sets the economic rules. In our society scientists, artists, researchers and entrepreneurs, who create the capital and future wealth of society, are denied access to capital while the corporate state lavishes itself. So, instead of millions of Americans being paid a living wage, they rot. In places like Compton, Detroit, and New Orleans, they rot by the millions. Our prospective future leaders, possible discoverers of future medical advances, Nobel Prize winners and vibrant contributors to society live in poverty while completely incompetent bureaucrats make the decisions on who gets access to capital and how much. So, instead we see vacuous reality shows like the Kardashians making millions of dollars, we see corporate bureaucrats making tens of millions, we see professional athletes making tens of millions and we see banking criminals making tens to hundreds of millions. All determined by what values bureaucrats place on society and community. They share nothing in common with most Americans. Their view on character and morality is as distorted as their sense of self. A private for-profit banking system is and always has been completely at odds with capital creation and human development. It is at odds with the values of democracy, economic democracy and economic opportunity for all citizens.

We need a public banking system that serves the need of human development and democracy. One that allows people to create economic diversity and self-determination. Private banking is a relic of concentrated power and profit motive that does not serve democracy, a democratic economy or self-rule. Going back to the gold standard changes absolutely nothing. The gold standard throughout history has been a source of massive corruption at the expense of society. It’s a method of choking off monetary and economic growth so that will simply lock in the profits for the corrupt who have stolen everything from society. It creates the same economic dynamic as corporate lobbying does by limiting the democratic availability of money. Gold standard advocates are economic dunces. Period.

Follow the money. It’s all a delusion created by the unstable human mind. And one of the greatest delusions in history is the commodities, peak oil, permanently high commodities pricing, China miracle scam perpetuated by endless fraud on Wall Street.

The Cycle Of Volatility And The Deluded Human Mind….. Soon delusion will be no more.

Commodities Index chart.